Industry

3i slashes third of workforce

3i has confirmed the extent of its cost-cutting strategy, which will see the firm lay off 160 staff and close several offices worldwide.

F1 buyout: Gribkowsky sentenced to eight years

Former BayernLB banker Gerhard Gribkowsky has been sentenced to eight years and six months in prison following his trial for corruption, breach of trust and tax evasion.

Awards tips – entries due this Friday

As the deadline for entries nears, unquote" is receiving lots of questions about the Awards. Here are some of the most popular queries and our responses.

UK Awards entries due in one week

Entries for the unquote" British Private Equity Awards are due Friday, 13 July.

UK support services boom in Q1 2012

The support services sector performed well in Q1 of 2012, raising expectations of strong growth for the remainder of the year.

Private equity allocations cautiously up, says LPEQ study

Around 16% of investors expect to increase their private equity allocation within the next six months, according to the recently released Scorpio Partnership LPEQ High-Net-Worth Asset Allocator survey.

BVCA and UKTI launch venture partnership

UK Trade & Investment (UKTI) and the British Venture Capital Association (BVCA) have come to an agreement to work closely together to promote the UK as an international centre for venture capital and engage with overseas investors.

LPs demand greater transparency from GPs

LPs are demanding more transparency from GPs and more support from governments to exhaust the full potential of private equity, according to Coller Capital's Global Private Equity Barometer.

LPs getting to grips with private equity's bad reputation

PE's image issue

LP interview: Morgan Stanley AIP's Neil Harper

LP Interview

Secondary buyouts continue to boom, but for how long?

The European secondary buyout market is deeper and more active than the primary market, but buyers should beware that its health is ultimately dependent on the same factors that drive primary transactions. Anneken Tappe reports

Doughty raises $1.1bn from Norit sale

Doughty Hanson has sold activated carbon specialist Norit to US trade player Cabot Corporation for $1.1bn.

AFIC appoints Louis Godron as chairman

French private equity association AFIC has elected Argos Soditic partner Louis Godron as its new chairman.

Video: AXA Private Equity's Stefano Mion

Stefano Mion, the head of AXA Private Equity's UK operations, talks to unquote" news editor Greg Gille about the firm's fund-of-funds strategy.

PE marketers launch Pivot Partners

Emma Payne and Ingrid Tighe have launched Pivot Partners, a strategic marketing business focusing on the private equity industry.

How private equity helps build British businesses

Speak up for PE

3i pulls out of Habbo Hotel firm Sulake

3i has joined Balderton in pulling out of Finnish portfolio company Sulake following a scandal in one of the online games it runs.

Video: EBRD's Anne Fossemalle

unquote" editor-in-chief Kimberley Romaine speaks to EBRD director Anne Fossemalle about the latest trends in manager selection.

Listed PE discounts seen as buying opportunity

Wide discounts on listed private equity vehicles present a major buying opportunity, according to delegates at LPEQ’s recent conference in London.

Balderton dumps Sulake after documentary exposé

Balderton has dumped its stake in Finnish social networking company Sulake following a damning Channel 4 investigation into the firm.

Private companies rethink pricing

The recession has had little effect on company valuations, but now companies are becoming more realistic about their value, writes John Bakie

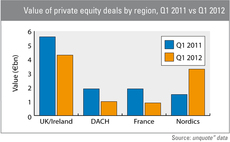

UK and Nordics outperforming rest of Europe

Research from unquote” data finds that the UK/Ireland has not only outperformed its continental European counterparts in Q1 of 2012, but it was also the only region to raise deal volume levels above those of 2011.

Trade winds blowing

Trade winds blowing

Listed private equity recovery underway

Listed private equity