Industry

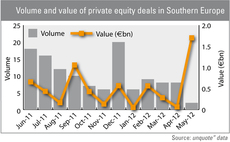

Southern Europe: Volume drops, value soars

Deal activity remained particularly subdued across Southern Europe in May, although the Rottapharm buyout in Italy sent overall value soaring.

The Nordic coming-of-age

The Nordic coming-of-age

PE players cashing in on energy services consolidation

Environmental, social and governance (ESG) issues are becoming more important to businesses, leading to the emergence of intense private equity interest in the energy management services sector. Research by Robert W Baird suggests an increase in deal...

Depositary requirements detrimental to VC fundraising, says EVCA

EVCA has raised concerns that the proposed depositary requirement for venture capital funds could be detrimental to the fundraising environment in Europe.

EU relaxes VCT scheme requirements

The European Commission has enhanced its state aid approval for the UK's Venture Capital Trust (VCT) scheme, loosening both requirements and restrictions on maximum funding.

Triago's Dréan launches online PE marketplace Palico

Palico, a global online marketplace for the private equity fund community, launched yesterday.

Netherlands: Out of sight for foreign GPs?

The latest market report from the Dutch private equity association (NVP) shows that GPs in the Netherlands have strengthened their position between 2010 to 2011. However further research by unquote" data reveals that the participation of international...

RIT partners with Rockefeller Financial Services

Investment trust RIT Capital Partners and asset manager Rockefeller Financial Services have announced the creation of a strategic partnership between the two entities.

Moody's forecasts €33bn+ LBO default

More than a quarter of unrated private equity LBO debt will default by 2015, according to ratings agency Moody’s.

Scandinavian banks downgraded by Moody's

Moody's has downgraded some of the most popular private equity debt providers in Scandinavia.

Tax authority demands Nordic Capital execs repay SEK 412m

Nordic Capital executives have been ordered to repay SEK 412m in carried interest tax, after the Swedish tax authority reached a final verdict in a lengthy investigation.

French LBOs top European performance tables, says AFIC

LBOs generated higher returns in France than in all other European countries in 2011, although their performance declined year-on-year, according to a recent study by private equity association AFIC.

Norway joins carried interest tax push

The Norwegian tax authority will classify carried interest as standard income, putting a few hundred million NOK of carried interest at risk.

CVC Capital Partners said to raise €10.75bn fund

CVC Capital Partners is in the process of raising a new Europe-focused fund targeting €10.75bn ($13.5bn), reports suggest.

Italian GPs ask: Why Not Italy?

Why not Italy?

European assets remain attractive despite euro crisis

Despite worries about Greece, Spain and Italy, US investors have demonstrated a continued appetite for European assets. Europe still remains a tough market for the moment and funds will have to play their cards right to maintain the interest of big American...

Private equity can unlock hidden investment opportunities, says Capital Dynamics

Concern about investing in Europe has obscured numerous investment opportunities, says Mark Drugan, managing director of European investment management at Capital Dynamics.

Welcome to the new look unquote.com

Welcome to the new look unquote.com

Swiss PE market threatened by regulatory reform

Regulation to hit Swiss PE market

Interview: Omnes Capital's Fabien Prévost

GP Interview: Fabien Prévost

Carried interest reform sweeps across Europe

As many European governments impose austerity measures, there is a growing demand for a crackdown on loopholes enabling the wealthy to reduce their tax bills. This has led to a re-examination of the rules surrounding carried interest and several major...

Dry powder will drive 2012 dealflow - Bain

Extensive dry powder, few exit opportunities and tough fundraising conditions will be the major drivers of private equity globally, according to Bain & Company.

Fundraising activity up by 80% in 2011

European private equity and venture capital fundraising increased by 80% in 2011, according to recent figures released by EVCA.

UK: GP confidence wanes

Only 57% of UK-based PE houses expect the British economy to pick up in 2012, according to Investec's latest private equity industry barometer.