Industry

Law firm e|n|w|c in merger with Taylor Wessing

Austrian law firm e|n|w|c has merged with international counterpart Taylor Wessing.

Governments' contribution to VC up six-fold

Government agencies and corporates are increasingly active in venture – but they should push further in support of European VC, argues Olivier Marty

Lack of distributions continues to fuel secondaries

Exit woes fuel secondaries

GPs warned over exit clauses

GPs are being warned to ensure pre-emption rights on deals are properly drafted, after recent cases highlighted potential pitfalls.

High yield to revive Europe's loan market

High hopes for bonds

Carlyle falls short of IPO target

The Carlyle Group raised $671m in its initial public offering, falling significantly short of its already conservative target of $762.5m.

AIFMD: Concerns over lack of suitable depositaries

AIFMD: Depositary shortage fears

JPEL extends credit facility with Lloyds TSB

JP Morgan Private Equity Ltd (JPEL) has extended a $150m multi-currency credit facility with Lloyds TSB Corporate Markets.

LP interview: SL Capital's Graeme Gunn

LP Interview

UK PE market defies recession

While the UK officially entered a double dip recession this morning, its private equity market has defied the gloom and is once again showing growth.

Video: Government raises pressure on Bribery Act

The Bribery Act makes it a corporate offence if a business with a UK presence fails to prevent a bribe.

German insolvency reform to boost turnarounds

Germany has recently reformed its insolvency law with the introduction of ESUG, the Act for Further Facilitation of the Reorganisation of Enterprises, which promises to make it easier for businesses to get out of administration and back on their feet....

Nordic sentiment: have your say

The Nordic private equity market has hit a few bumps in its road to recovery, with taxation issues overshadowing the regionтs otherwise impressive growth.

SVCA conference tackles industry reputation

Regulation and reputation were top of the agenda as private equity professionals gathered for the SVCA conference in Stockholm. Sonnie Ehrendal reports

Regulation update: FATCA

In this week's regulation update, Anneken Tappe takes a look at the impact of FATCA in Europe.

CEE Congress: regional banks lose ground to debt funds

Regional CEE banks are expected to lose ground to specialist debt funds in the local leverage market, according to a sentiment survey for the unquote” CEE Congress in London this morning.

Pledge funds not a panacea, says SJ Berwin's Sonya Pauls

Speaking at the annual unquote" CEE Private Equity Congress in London today, SJ Berwin partner Sonya Pauls highlighted the advantages of the currently popular deal-by-deal fundraising model, but also warned about its shortcomings.

CEE Congress: Growth set to fall in 2012

CEE economic growth is likely to fall to around 2.8% in 2012 warns senior economist at the IMF Rodolphe Blavy at today’s unquote” CEE Congress in London.

Climate Change Capital acquired by corporate

Cleantech-focused PE house Climate Change Capital (CCC) has been acquired by NYSE-listed agribusiness Bunge.

Fundraising tales reveal market split

The post-crisis fundraising market may be deemed one of the toughest ever, but not all GPs can rely on the same formula to succeed, as Chequers Capital and Blackfin Capital Partners explained at the annual AFIC conference in Paris last week. Greg Gille...

TRS head of PE steps down

Steve LeBlanc, head of private market investments at the Teacher Retirement System of Texas (TRS), will step down from his position in June and return to the private sector.

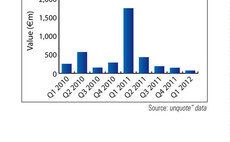

CEE activity: bottomed out?

Next weekтs CEE unquoteт Congress will reveal reader sentiment for CEE prospects.

HSBC sells remaining Montagu stake

HSBC has sold its remaining 19.9% stake in Montagu Private Equity to the management team, which spun the business out in 2003.

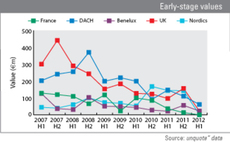

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.