Industry

InvestIndustrial closes third lower mid-market fund on EUR 1.1bn

Strategy will target businesses in Italy, Spain, Portugal and Switzerland with internationalisation potential

Paul Hastings hires private equity partner

Samantha McGonigle will join the Los Angeles-headquartered law firmтs London office

VC Profile: Klima lines up green energy deals from EUR 210m debut fund

Franco-Spanish Alantra and EnagУЁs-backed VC initiative expects to lay the foundations for its second fund in 2024

Squire Patton Boggs hires Dublin corporate partner from Philip Lee

George Kennedy will join the law firmтs new Dublin office ahead of its opening later this week

CapMan bolsters Wealth Services team, plans to scale up offering in Sweden

Finnish GP has hired Mika Koskinen from corporate bank SEB as managing partner for Wealth Services unit

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Gimv acquires majority stake in Witec

Belgium-based Gimv set to support Netherlands-headquartered contract design manufacturer’s growth

EQT weighs options for infection prevention firm Schuelke

Sponsor assesses quick flip for German company, acquired via EQT VIII in 2020

Newly launched Utopia Capital aims to deploy EUR 10m-plus by 2028

Angel investor Christian Schroeder's new investment vehicle will support early-stage tech companies addressing humanitarian issues

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

Slice of pie: New entrants gobble up GP stakes in Europe

Armen, Hunter Point Capital, GP House and Axa IM rustle up new minority investments, as Inflexion and Coller sell

Clayton, Dubilier & Rice hires European ESG head from FTI Consulting

Hannah-Polly Williams is the second addition to the US PE firm’s ESG initiatives group in the past six months

GP Profile: Opera Investment Partners doubles fund size with EUR 200m target for next vehicle

Fund I тalmost fully committedт with one exit completed and two-three more realisations expected in the next 18 months

Germany's DFL to collect NBOs for EUR 3bn media rights stake

Large-cap sponsors including Advent, Blackstone, Bridgepoint, CVC, EQT and KKR expected to bid today

Women in PE: Foresight's Alvarez on SME deployment plans, regional expansion drive

Partner Claire Alvarez speaks to Unquote about opportunities in the current market and the UK-based sponsorтs diversity ambitions

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

Forbion raises combined EUR 1.35bn for venture and growth funds

Ventures Fund VI closes on EUR 750m and Growth Opportunities II on EUR 600m with both upsized by over 60%

Gilde Healthcare hits EUR 600m target for Venture&Growth VI

Fund is 50% larger than predecessor thanks to “loyal” LP base; seeks late-stage deployment in medtech, digital health and therapeutics

Houlihan Lokey poaches Nielen Schuman's Theys to open up Antwerp office

Hire to cement Houlihan Lokey’s position in Belgium, which represents 30% of the advisor’s Benelux deals

GP Profile: Aurelius goes global with US expansion as it eyes new EUR 800m fund

German carve-out specialist is 18-24 months away from fundraising for its Fund V with EUR 750-EUR 800m target

Squire Patton Boggs hires funds partner from MJ Hudson

Rob Ekeтs move follows Apex Groupтs acquisition of several business divisions of asset management service provider

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

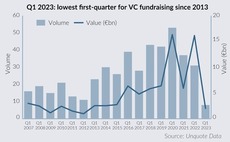

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Houlihan Lokey hires new capital markets MD from Numis

David Kelnar told Unquote that the firm is seeing a growing pipeline of companies looking to fundraise