Venture

Project A opens first international office in London

Principals Sam Cash and Jack Wang, plus associate Luc de Leyritz, will head the new office

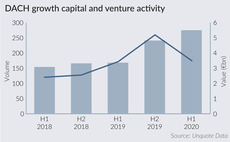

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

Future Planet Capital acquires Midven

Midven was founded in 1990 and focuses on West Midlands-based science and technology investments

Montana Capital completes US venture secondaries deal

Transamerica Ventures spinout HighScale Ventures will manage the assets following the sale by Aegon

VCs in $290m round for grocery delivery platform Gorillas

Grocery delivery startup claims to reach customers in 10 minutes and is reportedly valued at $1bn

Biotech market provides dose of optimism

In the past year, the biotech market has seen buoyant activity, reaching record levels of investments

Unquote Private Equity Podcast: Venture's immunity

Simon Philips, CEO of ScaleUp Capital, joins the Unquote podcast to explore recent trends in the European venture space

Evolving VC landscape helps fuel venture secondaries

Backing a portfolio of companies after various funding rounds gives comfort to some investors, with valuations seen as more concrete

DACH venture and growth deals peak in crisis

Following a strong year in volume terms, market participants remain optimistic about the resilience of the venture ecosystem

Southern Europe's VC industry grows amid pandemic

VC ecosystem has not been immune to Covid-19, but has been able to react more promptly than traditional segments of the PE market

Video: Frog Capital's Mike Reid on growth equity's chance to shine

Reid recaps a busy year for Frog and shares his experience of dealing with the Covid-19 crisis

VC Profile: VNV Global

Managing director Per Brilioth discusses portfolio company Voi, seeking network effects and investing in companies at the idea stage

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Finland's VC industry remains buoyant despite pandemic

Dealflow in the Finnish VC market remained strong in the peak months of the coronavirus outbreak, with local players cautiously optimistic

DACH venture capital looks for a new normal

Although dealflow in the DACH VC market has remained fairly strong, deals have shrunk in average size, and uncertainty lingers

Nordic GPs find solace in demand for tech deals

Buyout activity in the Nordic region has nose-dived in 2020, while venture capital activity surged in some countries

Unquote Private Equity Podcast: Startups slow down

The Unquote pod asks, when will VC activity return to normal? And how will venture funds rebound in comparison to the previous GFC?

EQT Venture leads $30m series-B round for Anyfin

Swedish fintech Anyfin has so far raised more than тЌ40m since 2018

VC Profile: Isai reaches 1st close in lockdown

Founder Jean-David Chamboredon discusses the challenges of raising a fund in lockdown, and plans to deploy capital in an uncertain environment

E-scooter startups feel brunt of lockdowns but anticipate future upside

The coronavirus lockdown in Europe has put a brake on the transport sector - should e-scooter startups and their investors be worried?

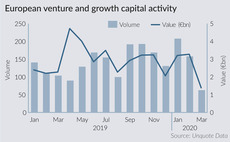

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

German VCs call for more Covid-19 startup support

Concerns centre around the profitability criteria, as well as local banks' lack of familiarity with startups' risk profile

VC Profile: CapitalT

Co-founder Janneke Niessen talks to Unquote about the firm's fundraise and its data-driven model to analyse startup teams

Unquote Private Equity Podcast: Nothing ventured, nothing gained

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team tackles the venture capital space