Benelux

Thuja closes second fund on €34m

Thuja's second vehicle is almost double the size of its €19m predecessor fund

Gimv in talks to sell Lampiris to Total

Gimv invested €40m in Lampiris via its Gimv XL buyout fund alongside SRIW in 2013

Gilde closes fourth fund on €250m hard-cap

Gilde Healthcare focuses on medtech, digital health and therapeutics in Europe and the US

Real Impact raises €12m series-A from Gimv et al.

Backers include venture capital firms Fortino Capital and Endeit Capital

3i reaps £89m in Basic-Fit IPO

3i invested €97m in the company in 2013 through an MBO valuing it at €275m

Karmijn acquires art lessor Kunst.nl

Kunst.nl is the first investment made via Karmijn's second fund, Karmijn Kapitaal II

Karmijn Kapitaal closes second fund on €90m hard-cap

GP's first fund, Karmijn Kapitaal I, was launched in 2011 and has been fully invested

3i promotes Salmon to partner

Promotion comes alongside a series of European appointments for the GP

LSP closes $280m life sciences venture fund

Vehicle closes more than one year after holding its first close on €80m

Vendis Capital acquires Noppies

Vendis made the acquisition via its second fund Vendis II, which recently closed on its €180m hard-cap

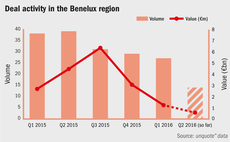

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Safinco takes 24% stake in Gimv's Vandermoortele

Family shareholders will regain full ownership of the business following the transaction

Menu Next Door gathers €1.75m in seed round

Belgian startup recently launched its activity in London, complementing Paris and Brussels

Vendis closes Vendis II fund on €180m hard-cap

Second buyout fund, launched in 2015, closes ahead of its €150m target

Sovereign backs MBO of Xendo

Life sciences consultancy will undertake a buy-and-build growth strategy

Showpad secures $50m in series-C round led by Insight

Belgian tech company more than doubled its revenues for the third consecutive year in 2015

3i's Basic-Fit announces intention to float

Company could be valued at up to €1bn for the listing, which could take place by year-end

Pamplona-backed Beacon acquires Ascendos

Portfolio build-up will enable Beacon Rail Leasing to expand its fleet of locomotives

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014

Endeavour et al. lead $25m series-D for Endostim

Endeavour Vision led the funding round alongside Gimv and Wellington Partners

UC Capital launches €150m Lions Growth Fund

Fund will be used for more than 10 investments across the EU and India over the next four years

CDC and Mubadala take minority stake in Galileo Education

Investment will help support activities of French subsidiary Studialis

TPG holds final close on $10.5bn

Vehicle is the first buyout fund raised by the GP since the global financial crisis

3i and Deutsche AM acquire TCR in €200m SBO

Both partners are acquiring the business from previous owners Chequers Capital and Florac