CEE

White Star invests $10m in Packhelp

Existing investors Speedinvest, ProFounders and Market One Capital also take part

Q&A: JCRA's Benoit de Bénazé

Some GPs are combatting risks arising from turbulent politics and economic uncertainty by making more frequent use of currency and risk hedging instruments

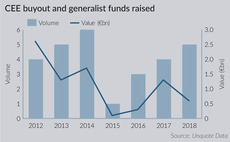

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

EQT Infrastructure fund hits €9bn hard-cap

Stockholm-headquartered manager announces the final close EQT Infrastructure Fund IV

Neveq targets €27m for third fund

Vehicle's predecessor Neveq II held a final close on €20.3m in 2014 and is now fully invested

Unquote Private Equity Podcast: European tour

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team examines the key takeaways from IPEM and SuperReturn

Penta-backed Sensiblu buys Belladonna

Belladonna had 93 pharmacies prior to the trasnaction and the divested subsidiary includes 46

Genesis backs IT specialist CN Group

GP deploys capital from its Genesis Private Equity Fund III, which closed on €82m in September 2016

Karma Ventures to start raising new fund in 2020

VC's first fund, closed in Q2 last year, is approximately 25% deployed currently

Pollen Street increases offer for Prime Car Management

Firm initially offered PLN 20 per share on 20 February, but has increased this to PLN 23.25

Unquote Private Equity Podcast: Crypto craze

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team decodes the intricacies of securitised token offerings

Japanese bank partners with BaltCap for €100m fund

BaltCapтs Kiisa will join the NordicNinja fund as managing partner alongside two JBIC executives

Secondaries in Private Equity

Unquote analysis of the secondaries market is now available for download

Multiples Heatmap: winter cooldown across Europe

Latest Multiples Heatmap, published in association with Clearwater International, is now available to download

Practica targets close on €40-50m in 2019

Practica Venture Capital II held a first close on €22m in December 2018, against a €40m target

Czech incubator launches €30m fund

New fund has been set up to invest at the series-A stage in B2B technology companies across Europe

Syntaxis sells Polflam to Baltisse

Firm's founders Maciej Szamborski and Wojciech Wilczak also make an exit in the sale

Innova Capital sells Neomedic in €70.5m deal

Sale of obstetrics-focused hospital group brings to an end a seven-year holding period

Mid Europa sells Bambi to Coca Cola for €260m

Mid Europa makes the divestment from Mid Europa IV, which closed on €880m in 2014

PG Impact Investments holds $210m final close

Firm is independent but has access to Partners Groupтs infrastructure, expertise and resources

BMO holds fourth close for co-investment fund on €95m

Fund was announced in February 2017 and is expected to hold a final close by the end of March

Unquote Private Equity Podcast: Dual speed ahead

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team navigates the bifurcation in private equity fundraising

INVL holds first close on €106m for Baltic Fund

Closing took place on 7 February 2019, seven months after the vehicle was registered in June

US investors eye European first-time funds

Maiden fundraises are maintaining momentum, with US institutional investors increasingly drawn to such vehicles