CEE

Turbo-charged: How leverage is powering up secondaries

The use of leverage in secondaries has soared, as funds are continually seeking new ways to boost spending power

Advent International in €1.91bn Zentiva carve-out

GP to buy generics business division Zentiva from French biopharmaceutical company Sanofi

CEE exit activity picks up in Q1 as buyouts drop

First quarter saw a significant drop in both buyout volume and aggregate value in the region, though the number of exits is up, year-on-year

Actera, Esas exit UN Ro-Ro in €950m trade deal

Danish ferry company DFDS Group is acquiring a 98.8% stake in UN Ro-Ro on a debt-free basis

Eos Venture Partners launches $100m debut insurtech fund

Vehicle has raised $30m from two insurance companies to date and will have a global remit

CVC-backed Avast to float on London Stock Exchange

Listing would result in a free float of approximately 25% of Avast's issued share capital

European Commission launches VentureEU

VentureEU is a venture capital funding programme backed by тЌ410m in fresh funding from the EU

PE-backed Sok readies for Istanbul IPO

Trading on the Instanbul stock exchange is expected to commence in May 2018

Mediterra sells ACP to Howden

Deal ends a four-year holding period under Mediterra, after the GP acquired the firm in April 2014

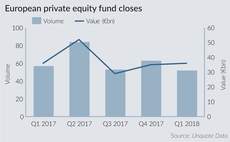

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

Ontario Teachers' chief investment officer Graven Larsen resigns

Graven Larsen joined Ontario Teachers' in February 2016 and led the fund's global investment programme

Innova holds €194m first close for sixth buyout fund

GP exceeded its minimum target of €150m and has raised 60% of the hard-cap, set at €325m

Eversheds hires Karwacki from Squire Patton Boggs

Michal Karwacki will be working as a partner in the law firm’s corporate practice group

Arx makes 11.8x on €53m Vues trade sale

Divestment of Vues generates an overall 11.8x cash-on-cash return multiple and an IRR of 30%

3TS exits MammothDB in trade sale

GP provided a €1.6m round of funding for MammothDB in May 2015 along with Empower Capital

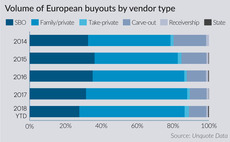

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Enterprise Investors acquires 65% stake in Pan-Pek

Transaction is the final investment made via the GP's Polish Enterprise Fund VII

Mega-buyout volumes hit post-crisis Q1 high

Combined with Q4 2017, the past six months have represented the most active consecutive quarters for тЌ1bn-plus buyouts since 2007

Novalpina to acquire 64% stake in Olympic Entertainment

Novalpina made an offer of €1.90 per share in a deal valuing the online casino operator at €288m

BPM Capital backs DenEesti MBO with mezzanine

With the capital injection, DenEesti will start operations in new ports along the Baltic sea

EIF's push into private capital management

The European Investment Fund is aiming to raise up to тЌ2.1bn in private capital for a new investment platform focused on venture and growth vehicles

PE-backed Sok to list on Istanbul Borsa

Listing could comprise up to 35% of shares, with the IPO reportedly set to complete in May

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity