CEE

Secondaries: all systems go following bumper 2017

Following a slump in 2016, the global volume of PE secondary transactions increased last year to reach new records

Value4Capital holds €80m close for Poland fund

Commitments include funds from EIF and EBRD, as well as capital from private Polish investors

Abris promotes Gieryński to managing partner

Gieryński is promoted from his position of chief investment officer for the buyout house

CEE Fundraising Report 2017

An in-depth statistical analysis of recent fundraising trends in CEE, with insight from local experts, now available to download

Triton-backed OptiGroup completes bolt-ons in Romania, Finland

Acquired businesses are expected to post a тЌ50m combined turnover, according to OptiGroup

Prime Ventures leads $38m series-C for AImotive

Other backers in the round include Cisco Investments, Samsung Catalyst Fund and Inventure

European PE in 2018: beware the bullet

unquoteт brings together a group of leading practitioners to analyse industry developments during 2017 and discuss emerging trends heading into 2018

Baltcap sells Magnetic MRO to trade for €43m

Number of employees has increased from 160 to 440 under Baltcap's ownership

European PE in 2017: fundraising tailwinds and growing leverage

Industry professionals look back on a resilient year for private equity during a period of turbulent geopolitics

Enterprise sells Netrisk.hu to MCI for €56.5m

Deal ends a seven-year holding period for the GP, which acquired an 80% stake in July 2010

MSPEA leads acquisition of Korres

MSPEA and Profex will respectively own 56% and 14% of holding company Nissos

Enterprise sells Macon to Xella in trade sale

Deal ends a 12-year holding period for Enterprise, which acquired the business in 2006

CDC IC, RDIF inject €10m into Olmix

Russian investment fund and French state investment arm extend their partnership to smaller deals

Jet Investment acquires Hoeckle Group

Deal marks Jet Investment's second cross-border investment in 2017 from its Jet I fund

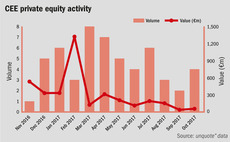

CEE closes out 2017 with strong investor confidence

Fundraising and deal activity both increased in the region during 2017

Abraaj acquires minority stake in Biletal

Turkey-focused GP acquires the minority stake through its Anatolia Growth Capital Fund

Zubr buys stake in ActivePlatform

With the fresh capital, ActivePlatform intends to offer customised cloud brokerage services

Avallon acquires 70% stake in EBS

Remaining 30% stake will be divided between the management team and the co-founders

Espira holds first close for debut fund

Prague-headquartered investor launches its debut fund with a target size of €30m

Warburg Pincus sells Inea to Macquarie

Deal ends four-year holding period after Warburg acquired minority stake in April 2013

Vitruvian buys 30% stake in Bitdefender

Deal marks end of 10-year holding period for Romania-based PE firm Axxess Capital

Actera to acquire Gratis

Turkish buyout firm filed a request with the Turkish Competition Authority to acquire a 55% stake

Taxim buys Turkish lingerie designer Suwen

GP draws equity for the transaction from its €200m buyout fund Taxim Capital Partners I

Capital Partners acquires Ekoplast

Ekoplast plans to expand geographically in France and other regions of western Europe