CEE

Tar Heel backs Rockfin in first investment from Fund II

Tar Heel Capital has acquired a 60% stake in Rockfin, a Polish supplier of hydraulic and pressure systems.

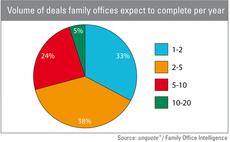

Family offices seek surge in deal origination

Family offices

EIF and KOSGEB launch €250m Turkish fund-of-funds

The European Investment Fund (EIF) and the Small and Medium Enterprises Development Organisation of Turkey (KOSGEB) have established a Turkey-focused fund-of-funds targeting €250m.

Doughty divests Vue to Omers and Alberta for £935m

Doughty Hanson has sold cinema group Vue Entertainment to Omers Private Equity and Alberta Investment Management Corporation (AIMCo) for an enterprise value of ТЃ935m.

Mir Capital buys stake in Packer Service Group

Mir Capital has made its first investment with the acquisition of a non-controlling stake in Russian oil and gas solutions firm Packer Service Group.

TPG and VTB consider Lenta listing in London

TPG and VTB Capital are in talks with banks concerning a possible London listing of Russian supermarket chain Lenta.

Metastudy: Private equity drives innovation and growth

A new secondary research report has found that private equity investing leads to increased foreign investment and improvements in innovation.

Enterprise closes Polish Enterprise Fund VII on €314m

CEE-focused GP Enterprise Investors has closed its latest fund, Polish Enterprise Fund VII (PEF VII), on €314m.

EU postpones Solvency II rules on pensions

The European Commission has postponed a bid to apply Solvency II style rules to pension funds as part of the revised IORP Directive.

Mid Europa acquires Polish Cable Railways for PLN 215m

Mid Europa Partners has wholly acquired Polish Cable Railways (PKL), Poland’s oldest cable car provider, from the state-owned Polish State Railways (PKP) group for PLN 215m.

Law firm Edwards Wildman Palmer opens in Istanbul

Private equity-focused law firm Edwards Wildman Palmer (EWP) is set to open an office in Istanbul, covering the CEE and MENA regions in addition to the Turkish market.

Advent steps back from CEE: Interview with Joanna James

Advent in CEE

CEE: Under-marketed and overlooked?

Central & Eastern Europe is a strong performer over a 10-year investment horizon, but investors remain wary. Is it time to take another look at the region? Kimberly Romaine reports from Warsaw

Warburg Pincus buys stake in Inea

Global private equity firm Warburg Pincus has acquired a minority stake in Polish cable operator Inea SA.

Enterprise reaps 10x on Magellan

CEE investor Enterprise Investors makes 10x on share sale of Magellan, 10 years after backing the business. The returns come just a week after the GP made 9x on Kruk.

Elbrus Capital buys minority stake in B2B-Center

Elbrus Capital has acquired a 23% stake in Russian online procurement marketplace B2B-Center.

Enterprise makes 9x on Kruk

Central European investor Enterprise Investors has fully exited its investment in Kruk after a 10-year holding period.

CEE unquote" April 2013

It’s official: Central and Eastern Europe is unsexy. It is the least desirable geography for family offices to invest in, according to the Investec Family Office Intelligence Survey, an unquote" sister brand, conducted in March.

CVC in court over $800m beer tab

CVC Capital Partners’ sole deal in Central & Eastern Europe – the local breweries of Anheuser-Busch InBev, StarBev – may leave the GP with a nasty hangover after court filings revealed AB InBev is seeking earn-out money following CVC’s subsequent sale...

CEE private equity: undervalued?

CEE: undervalued?

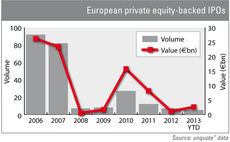

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Enterprise Investors backs Elemental Holding with €7m

Enterprise Investors has injected €7m into Polish specialist recycling company Elemental Holding in exchange for a 10.2% stake in the business.

CapMan raises €97m for Russia II fund

CapMan has held a first close for its CapMan Russia II (CMR II) fund on €97m.

Founder of CEE GP Penta steps down

Martin Kúšik, the co-founder of central European investment group Penta Investments Group, will end his operational involvement in the firm he set up in 1994.