DACH

Nystrs considering further European fund commitments

US pension fund has increased the number of active partnerships in its private equity portfolio

Arcus sells Kama to Premium Equity

Deal for the printing and packaging machinery firm is the third from the GP's short-term maiden fund

Therachon nets $60m mezzanine from Novo et al.

Existing investors Versant Ventures, OrbiMed, BPI France and Inserm Transfert Initiative also take part

CGS-backed ICG acquires Freeman Schwabe

ICG intends to strengthen the company's business with a focus on the North American market

Valar leads $13m series-A for Taxfix

Existing investors Creandum and Redalpine also took part in the round for the German startup

Strong exit environment helps drive Pantheon's returns

Sales to corporate buyers were the most significant source of exits, PIP says in its results

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

Hamilton Lane asset footprint hits record high

Firm plans to keep growing its existing funds across primary, co-investment and secondary strategies

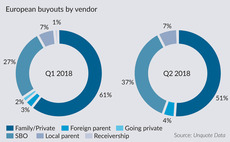

Record SBO numbers helped drive buyout dealflow in Q2

Q2 2018 saw 94 buyouts sourced from other GPs, setting a new quarterly record for European private equity

DPE tests LP appetite for fourth fund

DPE III held a final close in €575m in January 2017, up from the €350m raised by DPE II

Afinum-backed Liftket buys Chainmaster

Chainmaster will continue to operate independently but will benefit from synergies

Adcuram buys MEA Group

Corporate finance house Raymond James acts as exclusive financial adviser to MEA's shareholders

Finatem buys GfS

Fourth investment Finatem has made in 2018 and the sixth from its latest buyout fund

Triton-backed AVS Verkehrssicherung buys KMK

AVS Verkehrssicherung plans on strengthening its footprint across Europe

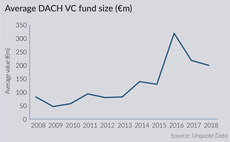

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

Main Mezzanine Capital holds first close for maiden fund

Mezzanine division of Main Capital first started investing via a €50m capital pool

Paragon buys Innere Medizin from UCB

Paragon draws equity from its €412m buyout fund, which held a final close in 2017

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

Pemberton targets €2.5bn for second European debt fund

Vehicle's 2016-vintage тЌ1.2bn predecessor is now understood to be fully deployed

DPE sells Ziegler to trade for €125m

GP makes the divestment from DPE Deutschland II, a €350m buyout fund that closed in 2012

CapVest targets €1bn for fourth fund

Vehicle is a significant increase on CapVest Equity Partners III, which closed on тЌ482m

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

Circularity leads €37m series-A for Grover

Consumer electronics rental platform undertakes international expansion and invests in marketing

Aleph, Crestview invest €260m in Keyhaven-backed Darag

Darag has completed 23 run-off transactions in Europe with a total value of more than €740m