DACH

Credo and Talis co-led a €4m series-A for Price FX

Prague-based venture capital house Credo injected capital from its second vintage, Credo Stage 2

Advent, Bain buy German payment service Concardis

GPs have acquired the business to lead a market segment consolidation across the DACH region

Alpina backs German software developer Gefasoft

GP acquires an undisclosed stake in the business from its 2013-vintage Alpina Partners Fund vehicle

EMBL, Life Sciences Partners lead €8m series-A for Luxendo

GPs completed the funding round launched in 2015 with an additional €2m injection

TA Associates buys Think Project

GP acquired an undisclosed stake from former investor Walter Beteiligungen und Immobilien

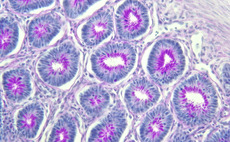

Boehringer Ingelheim leads €9m series-A for Heparegenix

Backers to the funding round include Novo Seeds and High-Tech Gründerfonds

Main Capital invests in Artegic

Benelux player Main Capital opened a local office in the DACH region in August

Deutsche Private Equity closes third fund on €575m

Third fund is raised four years after its predecessor, significantly exceeding fund II's €350m

VR Equitypartner buys minority stake in GBS

As part of the deal, existing investors will retain the controlling stake

CBPE buys German solvent producer Safechem

Deal marks the third investment for the GP’s latest vehicle, CBPE Capital Fund IX

KKR tenders offer for GfK

Following the deal, KKR and the company will own a combined 75% stake in the business

Silver Lake leads funding round for Flixbus

Backers include existing investors General Atantic and Holtzbrinck Ventures

King & Wood Mallesons partner Brenner moves to Orrick

German lawyer Brenner and two associates will leave KWM for Orrick

EQT exits BSN Medical in €2.74bn trade sale

EQT had acquired the group from Montagu Private Equity in 2012 for €1.82bn

HQ Equita sells Stettler to Groupe Imi

GP sold its controlling stake in the business via a trade sale after five-year holding period

Silverfleet sells Orizon for €81.6m

UK-based GP has sold its stake in the business via a trade sale after nine-year hold

LBBW leads €6m series-B for Amcure

Backers include existing investors KfW, MBG and S-Kap Unternehmensbeteiligungs

Warburg Pincus-backed United Internet in €600m Strato deal

Acquisition comes one month after the GP first backed the company's business application division

Mandarin hires two in Italy and Germany

GP boosts its Milan team with a new partner and new head of its German office

Invision acquires TintenCenter

Deal marks the second acquisition for the GP in the printer consumables e-commerce segment

Adveq closes Adveq Europe VI on €462m

GP closed Adveq Specialised Investments and Adveq Europe Co-Investments earlier in 2016

Apax Partners buys Unilabs from Nordic Capital and Apax Partners France

As part of the deal, Nordic Capital and Apax Partners France fully exited the business

DBAG buys Dieter Braun from Seafort

GP acquired its stake via the DBAG Fund VI vehicle, which reached a €700m final close in 2012

DACH buyouts on the rise throughout 2016

Despite low dealflow, the region saw an increase in buyouts during the course of the year, as aggregate value remained resolute