DACH

Ufenau VII closes on EUR 1bn hard-cap

Switzerland-based buy-and-build specialist plans to make 13-15 platform deals from the fund

Findos exits Karriere Tutor to Trill Impact

The GP has sold the German digital training provider just a year after entry; fifth platform deal for Trill Impact

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

Vitruvian makes USD 35m investment in Moonfare

Deal comes shortly after Insight Partners led a USD 125m Series C for the PE investment platform

GP Profile: Patrimonium Private Equity aims for full fund deployment and add-ons in 2022

Swiss sponsor has EUR 150m in fund commitments and expects two to three more platform deals this year

Novum-backed MMC Studios up for sale amid content production boom

Novum Capital bought the Germany-based film and television production company in 2019

Trill Impact set for venture fund following Domin appointment

Alex Domin has joined the Stockholm-headquartered impact investor as co-head of ventures

Mirabaud appoints Nouri as partner, plans new Lifestyle fund

GP plans to launch the second fund in its consumer-focused Lifestyle strategy later in 2022

EMK Capital gears up for third fund

European mid-market investor held a final close for its predecessor fund in 2020 on EUR 1.5bn

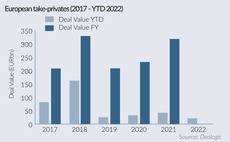

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

DBAG acquires Akquinet

Listed German GP said in a statement that it has now invested in five IT service businesses to date

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

GRO Capital holds EUR 600m final close for Fund III

B2B software-focused fund is more than twice the size of its EUR 255m, 2018-vintage predecessor

Hg gears up for MEDIFOX DAN exit

Houlihan Lokey will advise on the sale of the healthcare software group, which has already seen interest from large sponsors

BEX Capital raises USD 765m for Fund IV

Secondaries fund-of-funds remains open for no-fee, no-carry investments from NGOs and non-profits

Ufenau moves Corius and Altano to continuation fund

Bought in 2017, the dermatology and vet groups have been transferred into the Swiss GP’s third continuation vehicle

Evoco promotes Sormani to partner

Following Lorenzo Gregory Sormani's promotion, the Zurich-based GP is planning further hires

ESG from 'nice to have' to prerequisite for almost all LPs – survey

Adams Street Partnersт 2022 Global Investor Survey gauged LPsт views of 118 LPs globally

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

Nord Holding launches Small-Cap Fund

Small-Cap strategy will be led from Frankfurt by former VR Equitypartner executive Jan Markus Drees

Corsair-backed IDnow explores sale advised by Goldman Sachs

Auction for German biometric and digital identity provider is expected to launch in Q2 2022

Disruptive leads USD 250m round for Forto

Latest round brings the supply chain and logistics software platform's valuation to USD 2.1bn

Tikehau hires Ricardo Sommer as head of PE Germany

Executive joins from Silverfleet to build Tikehau’s local franchise following the GP's first PE deal in DACH