DACH

Ufenau closes Continuation III on EUR 563m

Swiss GP's new fund is backed by blue-chip secondary investors including StepStone and Five Arrows Secondary Opportunities

Stirling Square gears up for fifth fund

Fund registration comes just over two years after the EUR 950m final close of Stirling Square IV

A&M makes two transaction advisory hires in Germany

Hinrich Grunwaldt joins the Hamburg team from EY; Andreas Frisch joins in Frankfurt from Deloitte

Project A steps up PE co-investments, promotes Rösler to partner

Christoph Rösler speaks to Unquote about the development of the buyout and growth co-investment strategy

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

ICG, Ares and GBL among sponsors in Sanoptis second round

Current backer Telemos wants to remain invested as a minority shareholder in the ophthalmology group

EMZ exits Ankerkraut to Nestlé for 2x money

Deal marks the first full exit for EMZ Fund 9 and ends a holding period of less than two years

Hg bolsters team with promotions and new hires

GP has promoted three to partner and fills newly created role, head of talen

Silverfleet exits Prefere Resins in SBO to One Rock

Concerns about Russian exposure and raw materials costs surfaced in the sale process, Mergermarket reported

EMZ acquires FotoFinder Systems

EMZ is acquiring a majority stake in the medical imaging company via EMZ 9, which is 80% deployed

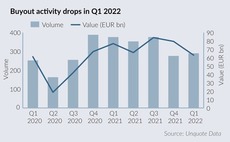

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022

Scout24 eyed by buyout groups including H&F, EQT, Permira

The downward trend in its share price has put the German real estate marketplace back on the radar of cash-rich sponsors

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

Nordic forms Bilthouse through mortgage broker acquisitions

The GP will merge Baufi24, Hüttig & Rompf and Creditweb to form new company; deal made through Nordic Capital X

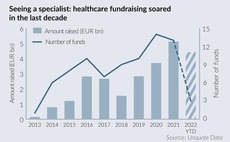

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Access holds EUR 375m first close for ninth flagship fund

Managing partner Philippe Poggioli speaks to Unquote about the Access Capital Partners' small-cap buyout fund-of-funds strategy and the GP's latest fundraise

Nordwind reaches first close for debut technology fund

GP has been making technology investments deal-by-deal since 2012 and is now raising a EUR 160m fund

Main Capital creates software group enventa after four DACH deals

With EUR 25m in combined revenues, new buy-and-build platform will focus on ERP, business intelligence and financial solutions

Polaris Investment Advisory makes board appointments

Eon's Dajana Brodmann, Axiom's Marc Lau and Omega Capital's Pablo López de Ayala bolster the board

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

Pinova Capital promotes Hofbauer to partner

Jean-Marie Hofbauer joined the Munich-headquartered Mittelstand technology investor in 2015