DACH

Nuveen closes impact fund on USD 218m

GP could return to market for Fund II in 2022 or early 2023 given current deployment opportunities

Hamilton Lane opens Swiss office

EMEA head of client solutions Ralph Aerni and vice-president Rainer Kobler will head the initiative

BC Partners announces EUR 6.9bn fundraise for BC XI

Final close fell below the original target;Т GP expects to return to market for its next fund in H2 2023

Eight Advisory opens Cologne office; appoints KPMG's Luchtenberg

Fourth German office will be headed by Curt-Oliver Luchtenberg, who has joined from KPMG

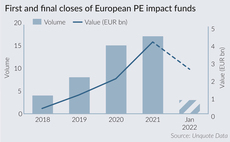

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

Access Capital registers ninth growth buyout fund

Fund-of-funds strategy makes primary and secondaries deals, backing funds investing in European SMEs

Coller to close USD 1.4bn debut credit secondaries fund

GP launched its first dedicated secondaries fund in May 2021 and has commitments from around 30 LPs

Syz, Saturnus buy SK Pharma

Pharmaceutical wholesaler has been growing at a 28% compound annual growth rate

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

EMEA M&A surges in 2021

More than 10,500 M&A deals were recorded in 2021, worth a combined USD 1.54trn

Pinova buys Sematell from IMCap

Small-cap technology investor IMCap bought Sematell in a carve-out from Attensity in 2015

Bencis to buy chemicals company Höfer Chemie

GP plans to acquire a majority stake in the business, according to a competition authority filing

GP Profile: Triton lays out ESG plans

ESG head Graeme Ardus and recently appointed head of sustainable investing Ashim Paun detail the firm's approach to ESG

Planet First seeks sustainability investments ahead of EUR 350m fund close

Managing partner and co-founder FrУЉdУЉric de MУЉvius speaks to Unquote about the firm's evergreen fund and its investment strategy

TeamViewer attracted take-private interest last year amid PE boom

Frankfurt flotation of TeamViewer in 2019 delivered a bonanza for backer Permira

Summa holds EUR 2.3bn final close for Fund III

GP will continue its focus on resource efficiency, changing demographics, and tech-enabled companies

Cherry holds first close for EUR 300m growth fund

Almost two thirds of Cherry IV's capital will be reserved for follow-on investments

Prefere Resins owner Silverfleet readies imminent sale launch

Rhone Capital-backed ASK Chemicals is expected to establish itself as the frontrunner

Riverside sells Repa to Berkshire-backed PT Holdings

Manufacturer of spare parts for vending and catering mahines expected to post revenues of USD 1.2bn in 2021

Blossom holds USD 432m final close for third fund

VC will continue its focus on Series A investing in Europe, backing sectors including cryptocurrency

Buy-and-build a "super opportunity" for PE in healthcare services – panel

Dermatology, ophthalmology and diagnostic imaging all present attractive consolidation opportunities, panellists said

S4Capital, Stanhope launch S4S Ventures fund

S4Capital and Stanhope Capital will act as GPs for the marketing and advertising technology fund

Verdane closes debut impact growth fund on EUR 300m

Verdane Idun I will deploy tickets in a sweet spot of EUR 10m-15m, making 20-25 deals in total

Petershill IV closes on USD 5bn

Petershill Partners is operated by Goldman Sachs Asset Management and buys minority stakes in GPs