DACH

Assos of Switzerland for sale with William Blair advising

Sale process is advanced, with second-round bids expected near the end of this month

AutoForm bidder pool narrows to include Carlyle, Francisco Partners

Sale of the business has tightened after attracting early interest from a raft of sponsors and trade players

Lone Star to exit MBCC in EUR 5.2bn deal

Lone Star bought construction chemicals business of BASF, now renamed as MBCC, less than two years ago

Sponsors, trade bidders line up for Deutsche Windtechnik

Several funds and strategic bidders are due to present offers for the German wind services business

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?

DWS holds USD 550m final close for first PES fund

GP's first institutional fund will partner with lower- and mid-market GPs for mid-life secondaries

General Atlantic flagship fund GA 2021 closes on USD 7.8bn

Sixth flagship growth equity fund is more than twice the size of its USD 3.3bn predecessor

Advent International and Eurazeo acquire Datatrans

GPs plan to combine Datatrans with Planet to create a global integrated payments group

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Proventis hires Jan Wetter as M&A partner

Wetter was previously an M&A partner and office managing partner at EY in Zürich

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

Zooplus takeover to go ahead as 80% threshold is met

H&F and EQT Private Equity teamed up for a joint final offer for the pet products retailer in late October

Carlyle's tech fund buys majority stake in CSS

Deal should see Carlyle Europe Technology Partners IV moving closer to full deployment

ArchiMed's MED II fund fully invested following Cube buyout

Cube is the last platform investment for the MED II fund, which closed in 2017

Kempen holds EUR 173m first close for European Private Equity Fund II

New fund is focused on small and lower-mid-market private equity buyouts in Europe

Insight Partners leads USD 125m Series C for Moonfare

Moonfare exceeded EUR 1bn in assets under management in September

Marlin Equity readies Collenda for auction

Raymond James is advising on the process, which could kick off before year-end

Ufenau registers third continuation vehicle

Switzerland-headquartered Ufenau Capital Partners invests in services-focused SMEs

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

LP Profile: ACP opens up PE programme

Co-head of PE Michael Lindauer speaks to Unquote about the LP's allocation strategy and its approach in an increasingly competitive market

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

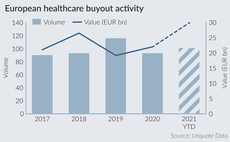

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

AutoForm sees Permira join bidder pool ahead of NBOs next week

Carlyle, KKR, EQT, Hellman & Friedman and Francisco Partners were previously reported as potential bidders

Will private equity bank on rising interest rates?

Sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations