DACH

Ufenau on track for Q1 2022 fundraise

Switzerland-headquartered service-focused GP is planning to raise its seventh flagship fund

Schenck Process owner Blackstone launches sale process

Sale could potentially generate as much as EUR 1.5bn in proceeds, sources say

Waterland invests in Horn & Company

GP and the management consultancy have entered into a 50:50 partnership, according to a statement

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

DPE's Calvias hits DACH auction pipeline

DPE has built Calvias through a string of acquisitions since its 2015 buyout

H&F matches EQT's EUR 3.36bn Zooplus offer

H&F has increased its EUR 460 per share offer for the pet products retailer to EUR 470 per share

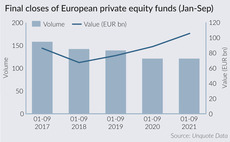

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Main Capital raises EUR 1.2bn across two funds

Of the capital raised, Main Foundation I has raised EUR 210m to back smaller software companies

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

Five Seasons closes second fund on EUR 180m

Food-technology-focused VC held a final close for its debut fund on EUR 77m in 2019

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

GP Bullhound closes Fund V on EUR 300m

Technology-focused firm's predecessor vehicle held a final close in June 2019 on EUR 113m

SGT, Tyrus announce strategic partnership

Collaboration will focus on capital markets-related PE deals in the US and Europe

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

Mutares set for capital increase to boost deal-making

Listed special situations investor aims to raise EUR 100m to back its future growth and investments

Golding launches debut impact fund with EUR 300m target

Golding hired Andreas Nilsson and Nina Freudenberg to lead its new impact strategy earlier this year

GP Profile: Gyrus looks to next steps after debut pandemic fundraise

Co-founder Guy Semmens discusses the GP's first-time fundraise, its deal pipeline, and the lead-up to its next fund

EQT joins H&F in Zooplus race with EUR 3.36bn bid

EQT's offer surpasses Hellman & Friedman's EUR 3.29bn bid submitted earlier in September

Bregal kickstarts ATP sale process; Morgan Stanley advises

Tapes specialist is expected to generate EUR 45m in EBITDA from EUR 175m in sales this year

Apax Digital Fund II holds USD 1.75bn final close

Technology-focused fund took less than four months to reach its hard-cap, Apax said in a statement