European PE activity could reach EUR 400bn mark in 2021

Europe was home to a record number of deals in the first nine months of the year, with Unquote estimating that the aggregate value of investments could approach EUR 400bn by year-end.

While Unquote researchers are still busy crunching full numbers for Q3 activity, the preliminary takeaway is clear: European private equity activity (ranging from early-stage to buyout investments) reached fever pitch in the first nine months of 2021, eclipsing previous records.

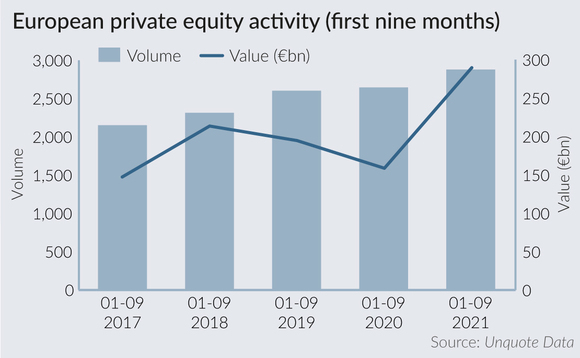

Unquote recorded 2,878 deals between January and September, for an estimated aggregate value of EUR 289.5bn. By comparison, the similar period in 2020 saw 2,645 transactions for a combined EUR 158.6bn – although the value figure in particular was severely impacted by the Q2 2020 drought in buyout activity following the coronavirus outbreak. But comparing to a more buoyant year, 2018, effectively highlights the scale of deployment in 2021: in the first nine months of 2018, Europe was home to 2,314 transactions valued at around EUR 213.6bn in aggregate value.

Q3 2021 has not been the strongest period this year, though, especially when it comes to buyout activity. Preliminary figures indicate that Europe saw 341 deals over the summer, for an aggregate enterprise value of around EUR 69.7bn. Volume was roughly on par with Q2 but around 7% down on a very busy Q1. Value rebounded slightly after a dip to EUR 65.9bn in Q2, but again could not match the EUR 73.5bn seen in the first quarter. It is worth bearing in mind that Unquote researchers will inevitably uncover more (likely smaller) Q3 deals in the coming weeks, so the volume figure in particular has the potential to match previous records.

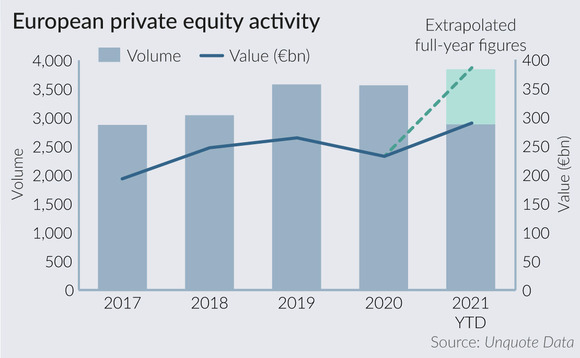

Extrapolating from the strong deployment seen overall so far this year highlights the extent to which 2021 could stand as the most prolific year ever for European private equity. If we were to average the numbers seen in each of the past three quarters, Q4 could be home to around 960 deals, totalling EUR 96bn. Added to the investments already banked so far this year, this would equate to full-year figures of 3,800 transactions worth a combined EUR 386bn.

Both would be clear records. The strongest year ever recorded by Unquote for deal volume was 2019 with 3,572 transactions. Meanwhile, aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play for.

Furthermore, Q4 deployment pace has historically been a bit stronger than in earlier quarters, as buy- and sell-sides rush to get deals over the line before the Christmas break. Add to that the fact that the GBP 7bn winning bid by Clayton Dubilier & Rice for UK supermarket chain Morrisons has not yet been reflected in the stats, and it is increasingly likely that the EUR 400bn mark could be reached by year-end.

Interestingly, this will not be down to a single (or a handful of) oversized transactions skewing totals, such as the EUR 17.2bn Thyssenkrupp deal last year. In fact, and barring the aforementioned Morrisons deal, most recent years have featured much larger individual transactions than seen in 2021 so far.

Instead, two combined trends are acting as clear drivers. The first is the sheer scale of buyout activity in the core mid-market (here defined as transactions valued between EUR 100m-500m). Unquote recorded 264 deals in that bracket in the first nine months of 2021, against 221 across 2019 as a whole. The aggregate value of these investments so far stands at EUR 54bn, already up 17% on the full 2019 tally.

Another driver is the incredibly frothy market for mega-VC rounds. As previously reported, the number and average ticket size of rounds in excess of EUR 100m rebounded spectacularly in Europe in the first nine months of 2021: the region saw 154 such investments for a combined EUR 44bn, more than the EUR 32.8bn across 123 rounds recorded in 2019 and 2020 combined.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds