European IPOs reach seven-year high in first nine months of 2021

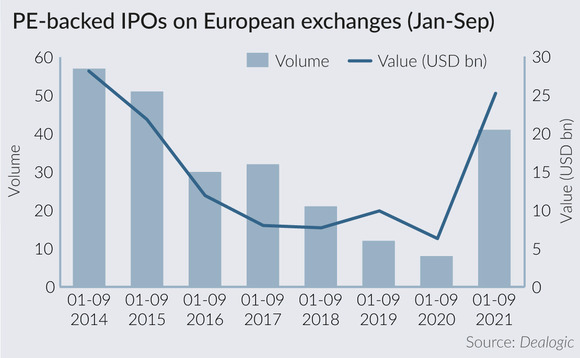

Sponsors have capitalised on the IPO window this year, with 41 private-equity-backed listings in the first nine months of the year on European exchanges, according to Dealogic data.

Back in May, Unquote reported that the volume of European PE-backed assets going public in 2021 was on track to reach a four-year high. Following the summer, an additional raft of listings has confirmed the trend.

In the first nine months of the year, financial-sponsor-backed IPOs on European exchanges reached USD 25.3bn in deal value across 41 listings, Dealogic data shows. This compares to just eight IPOs in the first nine months of 2020, worth a combined USD 6.3bn.

The 2021 value figure is the highest recorded since the first nine months of 2014 (USD 28.1bn), while the number of flotations is now the highest seen since the 51 IPOs recorded between January and September 2015.

Furthermore, the year-on-year rebound seen in 2021 so far (+299% in value terms versus the first nine months of 2020) is the highest ever recorded by Dealogic.

Among the 2021 blockbusters were the USD 3.9bn IPO of Poland's InPost by Advent International, Hellman & Friedman's USD 2.6bn listing of Spanish fund platform Allfunds, and the much-scrutinised Bridgepoint-backed Deliveroo IPO worth USD 2bn.

Selection of IPOs of European PE-backed companies

| Company | Sector | Country | PE backers | IPO date | Share price movement (current vs offer price) |

| Darktrace | Technology | UK | Talis Capital, Summit Partners, Invoke Capital, KKR, TenEleven Ventures, Vitruvian Partners | Apr 21 | 226.40% |

| Auction Technology Group | Technology | UK | TA Associates, ECI Partners | Feb 21 | 123.00% |

| Seco | Technology | Italy | Fondo Italiano d'Investimento | May 21 | 62.00% |

| Bike24 | Personal & household goods | Germany | Riverside Company | Jun 21 | 56.00% |

| Virgin Wines | Retail | UK | Connection Capital, Mobeus Equity Partners | Feb 21 | 5.08% |

| Dr Martens | Retail | UK | Permira | Jan 21 | 4.05% |

| InPost | Industrial goods & services | Poland | Advent International | Jan 21 | -9.38% |

| musicMagpie.co.uk | Retail | UK | NVM Private Equity | Apr 21 | -11.40% |

| In The Style | Personal & household goods | UK | Causeway Capital Partners | Mar 21 | -22.50% |

| Deliveroo | Technology | UK | Bridgepoint | Mar 21 | -23.50% |

| Made.com | Personal & household goods | UK | ProFounders Capital, Level Equity, Eight Roads Venture, Partech | Jun 21 | -30.00% |

Source: Unquote Data, Dealogic

Not all listings have fared equally, though. Deliveroo is a case in point, with the company's share price falling by more than 25% on its March market debut on the London Stock Exchange. Its share price steadily recovered between late June and mid-August, but has fallen again since. It currently sits at around 296 pence per share, equating to a -23% drop against the offer price.

While Deliveroo is a high-profile example, other sponsor-backed businesses have fared worse since their 2021 IPOs. These include posters and frames retailer Desenio (-49%), furniture company Made.com (-30%), and computer parts business Fractal (-27%).

On the other end of the spectrum, standout performers include cybersecurity software specialist Darktrace, backed by KKR and a host of VCs, with a spectacular 226% uplift in share price to date. Online auction platform Auction Technology Group, backed by TA and ECI Partners, has also fared very well since its February IPO, with shares currently up 123% against the offer price.

Sponsors have also tested investor appetite for the private equity investment case this year, attested by the successful listing of Bridgepoint in London and the most recent Paris IPO of Antin Infrastructure Partners in September. Both are sitting on comfortable gains, with Bridgepoint up 49% since its July IPO.

The pipeline for confirmed and potential sponsor-backed listings remains strong, too. This includes Sisal, backed by CVC, which was recently reported as having appointed advisers to prep for a 2022 IPO; Inflexion-backed Marley, which announced its intention to float in mid-September; and Carlyle- and GIC-backed Nouryon Chemicals, which filed its prospectus earlier this month, among others.

Click here to access the latest European IPO Pipeline, which offers a list of IPO-related intelligence covered by Mergermarket over the past month

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds