DACH

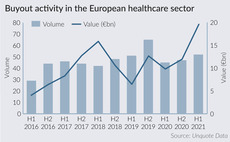

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

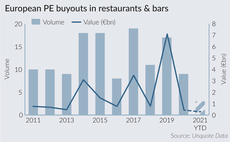

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Cross Equity, Pinova sell Rademacher to trade

GPs acquired the Germany-based smart home systems business in 2014 from Nord Holding

ArchiMed buys Stragen Pharma

GP is investing via its €1bn Med Platform I, which backs healthcare firms with EVs of at least €100m

Argand, Genui-backed Cherry to float in €778m IPO

Computer hardware firm was valued at around €200m when Argand took a majority stake in 2020

Riverside-backed Bike24 to list in €662m IPO

Riverside acquired Bike24 in 2015, selling it to Bridgepoint's Wiggle-CRC and buying it back in 2019

High-Tech Gründerfonds to launch fourth seed fund

Fund expects to launch its official fundraising process in September 2021, subject to BaFin approval

Emeram sells Meona to Trill Impact

GP bought the clinical software platform in 2017, investing via its €400m debut fund

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

Golding Capital holds first close on €161m for co-investment fund

FoF manager expects to hold a final close for the co-investment vehicle at the end of 2021

Unquote Private Equity Podcast: Fundraising full steam ahead

With record amounts of capital raised in 2020 and a roaring start to 2021, it seems not even a pandemic could slow the momentum of PE fundraising

Hannover Finanz buys majority stake in Dental Direkt

GP has acquired a 64% stake in the dental laboratory supplier as part of a succession solution

Carlyle invests in logistics automation company Agilox

GP is investing in the Austria-based logistics automation startup via its €1.35bn CETP IV fund

PE deal-making surge of 2021 could break one more record

Recent trends in the mega-deal segment indicate that the Alliance Boots buyout of 2007 is a record that is close to being broken

Paragon acquires KME's Specials business

Paragon Partners will own a 55% in the newly formed entity following the carve-out

VC fundraising enjoys strong 2020 vintage, sunny prospects

With record amounts of capital raised for the strategy, venture capital fundraising does not appear to have been slowed by the pandemic

HIG prepares Conet for H2 2021 auction pipeline

Sponsor appoints GCA Altium to advise on the sale of the €25m-EBITDA business

LGT closes fifth secondaries fund on $4.5bn hard-cap

GP had a target of raising $3.75-3.80bn for the fund, and is larger than its $2.8bn predecessor

Oakley hires new partner, makes raft of promotions

GP makes six promotions within its investment team, and hires Valero Domingo as partner

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Heubach, SK Capital Partners carve out Clariant Pigments

Carve-out values the company at up to CHF 855m with a CHF 50m earn-out component

Borromin invests in Little John Bikes

Borromin Capital has acquired a stake in Germany-based bike and e-bike retailer Little John Bikes.

DN Capital's Global Venture Capital V surpasses €200m

GVC V targets seed and series-A investments in the software, fintech and online marketplace sectors

Balderton holds final close for $680m debut growth fund

GP's previous vehicles have targeted earlier-stage primary and secondary venture deals