DACH

Top Tier Capital closes European fund on €260m

Fund makes primary and secondary investments in venture capital funds and co-investments in select portfolio companies

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Digital+ Partners gears up for fundraise

GP focuses on later-stage B2B technology companies and closed its previous fund in 2018 on €350m

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

Chequers Capital to carve out Corning Services

GP plans to assist the telecommunications service with a buy-and-build strategy

Hg-backed MeinAuto postpones IPO

Car sales platform cited "currently adverse conditions for high-growth companies" in a statement

HIG acquires majority stake in Infratech Bau

GP intends to support the infrastructure project contractor through organic and acquisitive growth

Paragon's Apontis Pharma completes IPO

GP acquired the single-pill producer in a carve-out in 2018 and will retain a 31% stake

Abingworth Clinical Co-Development Fund 2 closes on $582m

ACCD 2 finances the development of late-stage clinical programmes of pharmaceutical and biotechnology companies

Capza 5 Flex Equity Fund closes on €700m

Fund offers flexible financing that combines majority and minority equity, convertible bonds and mezzanine

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

Equistone buys majority stake in TimeToAct

Germany-based IT consultancy is to be Equistone's fourth platform investment of 2021

YielCo holds closes for PE and co-investment funds

YielCo Special Situations Europe II is targeting тЌ300m; YielCo Defensive Investments targets тЌ150m

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

Andera Partners lines up DACH expansion plans

Starting with BioDiscovery 6, the GP intends to accelerate fundraising and deal-making in the region

CVC leads growth investment in Acronis

Cybersecurity software developer is valued at $2.5bn, compared with $1bn at its last funding round in 2019

Gimv increases stake in GPNZ

Gimv has increased the size of the majority stake that it already held in the dental chain

Golding makes hires for new impact investing team

Fund-of-funds manager is to launch its first impact fund in H2 2021, having hired the team of Sonanz

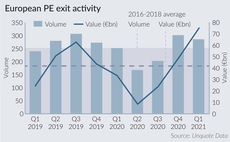

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Hg's MeinAuto sets IPO price range

Shares are each priced in the €16-20 range, corresponding to a €1.2-1.5bn market capitalisation

Gyrus holds close for Gyrus Investment Program

Program comprises Gyrus Principal Fund and its co-investment Cortex fund; it has a тЌ400m hard-cap

Hannover Finanz, Arcus acquire Löwenstark

Mittelstand-focused GPs aim to support the online marketing firm's growth and succession planning

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store