DACH

Ufenau buys majority stake in Matrix Technology

Deal is Ufenau's second in the IT service sector in 2020, following its investment in Ikor in April

Gyrus Capital hires two

Healthcare-focused GP was launched in early 2019 by former Argos Wityu partner Guy Semmens

DACH venture capital looks for a new normal

Although dealflow in the DACH VC market has remained fairly strong, deals have shrunk in average size, and uncertainty lingers

Genesis Capital launches €150m fund

GPEF IV will focus on investments in small and medium-sized companies with high growth potential

VCs exit UltraSoc to Siemens

Previous investors include Seraphim, Indaco, Octopus Ventures, Oxford Capital and eCapital

Waterland's Tineo bolts on Netrics

Consolidation strategy in the Swiss IT consultancy sector also saw Tineo acquire Nexellent in 2019

Mediobanca, Russell Investments launch third private market fund

Fund invests in secondaries, distressed assets and opportunities in dislocated industrial sectors

SwanCap nears final close for latest fund

SwanCap's private equity co-investment fund expects to close 20% above its €250m target

Video: Cambridge Associates' Marcandalli on impact investing moving centre stage

In a new instalment of Unquote's Lockdown series, Annachiara Marcandalli explains why it is unlikely that coronavirus will sideline impact investing

Left Lane, DN Capital back €8.3m round for GoStudent

Speedinvest backed a €1.5m round for the Vienna-based online tutoring company in July 2020

SHS appoints Jacqui as senior adviser

Heinz Jacqui has a medical technology background and will assist with SHS's investments in this area

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

Ardian appoints Erdland as senior adviser

Alexander Erdland has previously held roles including president of the German Insurance Association

VR Equitypartner increases stake in GMS Development

GP invested in the CRM software company in September 2015 and is now to acquire a majority stake

3i-backed Evernex bolts on Vitruvian's Technogroup

3i deploys €47m in capital, while Vitruvian rolls over a significant investment in the combined group

DEWB sells MueTec to trade

China-based Suzhou TZTek Technology is to acquire the company for €25m, according to a statement

Optum Vetures et al. back $26m series-B for Kaia Health

Idinvest and Capital300 also back the digital therapy platform, along with existing investors

BlackRock and ApoBank launch healthcare fund

BlackRock-managed fund aims to give ApoBank's institutional clients access to healthcare investments

HQ Capital closes Auda VIII on $750m

GP's latest fund-of-funds vehicle is its largest yet and is double the size of Auda VII

Aduram's Poggenpohl sold to trade

Deal has been approved by the company's creditors committee and is expected to close by the end of June

Providence in single-asset restructuring for HSE24

GP bought a majority stake in the shopping channel operator from Ardian in 2012 via its sixth fund

Schroder Adveq hires Unigestion's van der Kam to head secondaries

Van der Kam was co-head of secondaries at Unigestion and helped build the firm's secondaries platform

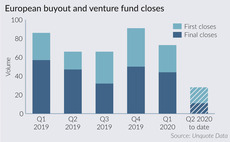

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Fly Ventures holds final close for second fund on €53m

Berlin-based VC will continue its focus on seed investments in enterprise software and "deeptech"