France

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022

Clearwater Multiples Heatmap: UK and Ireland deals pass 14x mark in Q4

With PE buyouts in Europe shattering records again in 2021, average multiples continued to move up in Q4

Gimv forms digital marketing agency Olyn

Company is built through four assets; will pursue further acquisitions locally and abroad

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

Advent buys Mangopay, Leetchi

Deal adds to GP's 17 fintech assets including Planet and Medius; sponsor has invested USD 6.5bn in fintech since 2008

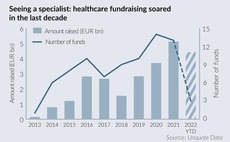

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Access holds EUR 375m first close for ninth flagship fund

Managing partner Philippe Poggioli speaks to Unquote about the Access Capital Partners' small-cap buyout fund-of-funds strategy and the GP's latest fundraise

CVC dribbles past Silver Lake, Oaktree, H&F to score Ligue 1 deal

Deal for 13% in French football league commercial arm will add to sponsor's collection of sports assets

The Bolt-Ons Digest – 1 April 2022

NorthEdge's Correla; LDC's Omniplex; QPE's Encore; Cinven's Barentz, Tenzing's Jeffreys Henry, and more

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

Equistone considers moving Sicame to continuation fund

GP is also studying a potential refinancing of the French electricity distribution products and services provider

EMK Capital gears up for third fund

European mid-market investor held a final close for its predecessor fund in 2020 on EUR 1.5bn

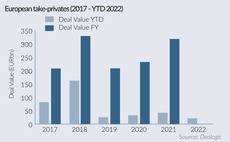

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

DiliTrust backed by Eurazeo, Cathay, Sagard Newgen in EUR 130m deal

Transaction will see Calcium Capital exit the French corporate governance services provider; Eurozeo to contribute with EUR 52m

BEX Capital raises USD 765m for Fund IV

Secondaries fund-of-funds remains open for no-fee, no-carry investments from NGOs and non-profits

Dawn Capital eyes two new funds

Software-focused VC makes early-stage deals; its Opportunities funds back its later-stage portfolio

ESG from 'nice to have' to prerequisite for almost all LPs – survey

Adams Street Partnersт 2022 Global Investor Survey gauged LPsт views of 118 LPs globally

Initiative & Finance eyes EUR 350m fund close 'as soon as possible'

French GP will seek to expand LP base internationally as travel restrictions ease and meetings in person resume

Sponsors kick off 2022 with buyout volume down 13% year-on-year

Energy costs, inflation and war in Ukraine cloud deal activity but value holds up with average deal size on the rise

Gimv exits Wolf Lingerie in NextStage-led SBO

French GP is joined by BNP Développement and BPI in investment for lingerie maker

Eurazeo PME to launch Redspher sale advised by Transaction R

Formerly known as Flash Europe, the French transportation business will be marketed off around EUR 20m EBITDA

Partners Group set for second PG Life fund

PG Life II is expected to follow the global impact investing strategy of its predecessor