France

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed

Carlyle injects €60m into Inova

GP invests via Carlyle Europe Technology Partners IV, a €1.4bn fund closed in 2019

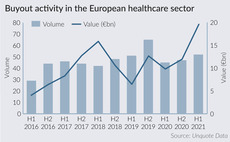

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Oakley to sell majority stake in Ace Education to trade

Exit will generate a gross return on investment of nearly 2.1x money and around 27% IRR for Oakley Capital Private Equity III

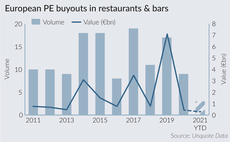

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Ashurst hires Dechert's Hellot

François Hellot spent 12 years as a partner with Dechert prior to joining Ashurst

Healthcare valuations heat up as high-profile assets crystallise competition

Healthcare sector saw multiple valuations pick up in Q1 2021 and hit a record high of 13.7x

Marlink admits Providence, I-Squared, CVC to second round of sale

France's Apax Partners is looking for bids in the region of 10x EBITDA for its portfolio company

Unquote Private Equity Podcast: Fundraising full steam ahead

With record amounts of capital raised in 2020 and a roaring start to 2021, it seems not even a pandemic could slow the momentum of PE fundraising

Eurazeo kicks off sale processes for Peters Surgical, In'Tech

Eurazeo recently said it would accelerate its asset divestment programme in 2021 and 2022

Ardian acquires NetCo from IK

IK's exit comes two years after it acquired a majority stake in the company via its IK Small Cap II Fund

PE deal-making surge of 2021 could break one more record

Recent trends in the mega-deal segment indicate that the Alliance Boots buyout of 2007 is a record that is close to being broken

Swen recruits two to launch Blue Ocean impact strategy

Christian Lim and Olivier Raybaud join as managing directors to focus on ocean regeneration

VC fundraising enjoys strong 2020 vintage, sunny prospects

With record amounts of capital raised for the strategy, venture capital fundraising does not appear to have been slowed by the pandemic

PAI to acquire SGD Pharma from JIC

Buyout reportedly values the pharmaceutical glass packaging producer at around €900m

Keensight to buy Adista from Equistone

Company is aiming to double its revenues from €153m in 2020 to €300m by 2025

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Silverfleet exits Coventya in €420m sale, nets 2.5x money

Trade sale comes five years after Silverfleet acquired the metal finishing business from Equistone

DN Capital's Global Venture Capital V surpasses €200m

GVC V targets seed and series-A investments in the software, fintech and online marketplace sectors

Balderton holds final close for $680m debut growth fund

GP's previous vehicles have targeted earlier-stage primary and secondary venture deals

10T Holdings leads $380m round for Ledger

Another 27 investors take part in the funding round, which gives the company unicorn status

Unquote Private Equity Podcast: Pandemic premiums

Following the publication of the Q1 2021 Multiples Heatmap, Unquote welcomes Clearwater's executive team to discuss pricing trends

Pollen Street Capital IV raises £560m, close to surpass target

PSC IV invests in lower-mid-market companies across the financial and business services industries