France

Eurazeo to ramp up divestments over next 24 months

Firm also expects fundraising to exceed the previous record of €2.9bn set in 2020

OpenGate heads for third fund launch targeting up to $700m

GP is currently investing its second fund, which held a final close on $585m in November 2019

Neuberger Berman launches ELTIF

Fund focuses on buyout opportunities blended with some growth and structured equity

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

General Atlantic leads €276m round for €2.6bn-valued Back Market

Round sees participation from Generation Investment Management, Aglaé, Eurazeo, Goldman Sachs and Daphni

Top Tier Capital closes European fund on €260m

Fund makes primary and secondary investments in venture capital funds and co-investments in select portfolio companies

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Raise, IDI buy PE-backed Talis Education

Azulis Capital and Aquiti Gestion invested in the professional training provider in January 2020

Eurazeo launches PME IV Fund

Eurazeo's PME arm deploys equity tickets of €20-100m, focusing on French mid-market businesses with EV of €50-200m

Abénex backs medical imaging software provider EDL

GP plans to support the company in boosting its organic growth and accelerating its expansion through targeted add-ons

Bain's Parts Holding Europe files for IPO

PE-backed IPOs have been scarce in France in the past five years, according to Unquote Data

Eurazeo invests in I-Tracing in €165m deal, Keensight exits

Following the deal, Sagard NewGen invests as a minority shareholder in a holding company controlled by Eurazeo

Keensight sells LinkByNet to Accenture

Deal ends a five-year holding period for Keensight, which invested €50m in LinkByNet in exchange for a minority stake

UI Investissement, Geneo back clinic operator GBNA

UI and Geneo invest in the company via a capital increase, partnering with the Guichard family

Abingworth Clinical Co-Development Fund 2 closes on $582m

ACCD 2 finances the development of late-stage clinical programmes of pharmaceutical and biotechnology companies

Capza 5 Flex Equity Fund closes on €700m

Fund offers flexible financing that combines majority and minority equity, convertible bonds and mezzanine

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

Advent leads $220m series-D for Shift at $1bn valuation

Avenir, Accel, Bessemer Venture Partners, General Catalyst and Iris Capital also take part in the round

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

Capza appoints Gauffre as head of sustainability and impact

In her new role, Gauffre oversees the structuring and development of Capza's ESG strategy and CSR policy

Andera Partners lines up DACH expansion plans

Starting with BioDiscovery 6, the GP intends to accelerate fundraising and deal-making in the region

Astorg buys Solina from Ardian

Sale ends a five-year holding period for Ardian, which acquired Solina from IK Investment Partners

Perwyn opens Paris office, eyes more investment on the continent

Firm has already made two investments in France: Isla Delice in 2018 and Keobiz in 2020

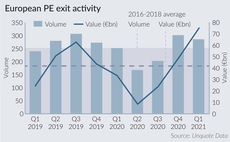

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers