France

Ergon in exclusive negotiations to acquire Telenco

GP plans to invest in the telecoms equipment producer via Ergon Capital Partners IV

PAI Partners appoints Boullier as managing director

In his new role, Boullier will lead IT and digital transformation across PAI and its portfolio companies

Consortium in €20m series-A round for Memo Bank

Company also announces it has been given the seal of approval to be a fully-fledged bank

Mediobanca, Russell Investments launch third private market fund

Fund invests in secondaries, distressed assets and opportunities in dislocated industrial sectors

Index Ventures leads €70m series-C for Swile

Company will use the funding to expand internationally, starting with Brazil

Video: Cambridge Associates' Marcandalli on impact investing moving centre stage

In a new instalment of Unquote's Lockdown series, Annachiara Marcandalli explains why it is unlikely that coronavirus will sideline impact investing

Omnes announces eight appointments in Paris

French GP has made appointments across various divisions

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

3i-backed Evernex bolts on Vitruvian's Technogroup

3i deploys €47m in capital, while Vitruvian rolls over a significant investment in the combined group

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

BlackRock and ApoBank launch healthcare fund

BlackRock-managed fund aims to give ApoBank's institutional clients access to healthcare investments

Idinvest completes secondaries deal for growth portfolio

Manager has transferred 12 companies into a new fund backed by secondary capital

HLD in exclusive negotiations to acquire TSG

Petrol station and fueling equipment provider was formerly owned by its management

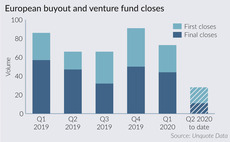

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Go Capital taken over by management

As part of this deal, Jerome Guéret is appointed as CEO and Bertrand Distinguin takes on the role of president

Meta Change Capital launches €100m fund

Fund is dedicated to investments in blockchain companies across Europe, Asia, the Middle East and Africa

Vast majority of LPs satisfied with GP transparency – survey

Coller Capital's PE Barometer also reported LP concerns about forward-looking EBITDA add-backs

Secondaries players weigh up risk and rewards of "ring-fencing" deals

GP-led transactions isolating assets hardest hit by the Covid-19 crisis could appeal to adventurous secondaries players, but challenges abound

Third of LPs put fund commitments on hold – survey

Brackendale Consulting survey also revealed that 62% would commit to a fund without a personal visit

Cerea to launch third buyout fund

Cerea also plans to launch its fourth mezzanine vehicle with a тЌ250-275m target next month

Iris leads $2.4m seed round for Monk

Fresh capital will be used to support Monk’s R&D programme and the recruitment of new team members

Highland backs €21m round for Alkemics

Existing investors including Cathay and Index also backed the brand and grocery partnership platform

Video: CPPIB's Delaney Brown on improved LP/GP relations

In the fourth of Unquote's Lockdown series, Delaney Brown, managing director of CPPIB, discusses improved GP/LP relations since lockdown began

EQT opens office in Paris

EQT partner Nicolas Brugère will take up the role of head of EQT France