Nordics

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner

Nordic Report 2012

Last yearтs closings of EQT VI (тЌ4.75bn) and HitecVision VI ($1.5bn) were not only the largest ever funds raised in their respective countries, but also signs of international interest in the region т both attracted significant global capital.

The State at play: Italian government jumpstarts flat market

The State at play

EIF commits €17m to Lithuanian SME funds

The European Investment Fund (EIF) has committed тЌ11m to the Practica Venture Capital Fund and тЌ6m to the Practica Seed Capital Fund.

IK buys Actic from FSN Capital

IK Investment Partners has acquired Swedish health and fitness business Actic from FSN Capital.

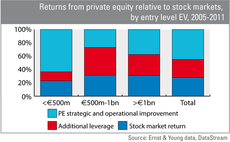

Mid-market leads value creation

Mid-market leads value creation

AIFMD having little impact on fund marketing

More than half of GPs say the Alternative Investment Fund Managers' Directive (AIFMD) has had little impact on their marketing activities with just a year to go until implementation, according to a survey by IMS Group.

Akina holds first close on €173.5m

Akina Partners has held a first close for its fifth fund-of-funds, Euro Choice V, on тЌ173.5m.

Via Venture acquires Hostnordic

Via Venture Partners and retail investor Christian Winther have jointly acquired a majority stake in Danish web hosting and IT outsourcing provider Hostnordic.

A Capital in DKK 185m PIPE for Bang & Olufsen

A Capital and Chinese luxury retailer Sparkle Roll have invested DKK 185m for a 7.71% stake in listed Danish high-end audio-video business Bang & Olufsen.

Coller's sixth fund hits $5.5bn final close

Coller Capital has held a final close for its sixth fund on $5.5bn, exceeding its original $5bn target.

CapMan exits Ascade to CSG Systems

CapMan has sold software developer Ascade to NASDAQ-listed trade player CSG Systems.

Video: Jonathan Blake advises on fundraising

Video: Jonathan Blake

Nordic Capital buys four consumer financing firms

Nordic Capital has acquired Swedish consumer financing, insurance and business support services providers Resurs Bank, Solid FУЖrsУЄkringar, Reda Inkasso and Teleresurs.

Ratos-backed Arcus-Gruppen buys spirits brands portfolio

Ratos portfolio company Arcus-Gruppen has acquired Nordic spirit brands Aalborg, BrУИndums, Gammel Dansk and Malteser from Pernod Ricard.

Norvestor acquires Abax

Norvestor Equity has bought Norwegian electronic trip logs provider Abax in a management buyout.

Q&A: Taylor Wessing on tech investment

Q&A: Taylor Wessing

G Square buys Mikeva from Intera

G Square Capital has acquired Finnish social care services provider Mikeva from Intera Partners.

Verdane Capital Advisors sells Prenax

Verdane Capital Advisors has sold Swedish subscription management company Prenax to French family office Arts et Biens.

Litorina backs Gullbergs MBI

Litorina has acquired a majority stake in Swedish office supplies provider Gullbergs.

Altor-backed Nimbus Boats goes under

Altor Equity Partners portfolio company Nimbus Boats has filed for bankruptcy.

EQT raises €1bn for infrastructure fund

EQT has raised more than тЌ1bn for its second infrastructure fund, reports suggest.

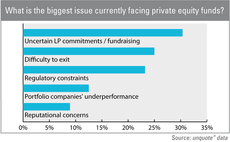

Fundraising a chief concern for Nordic PE professionals

While the AIFM Directive was on everybody's agenda last year, fundraising is the main concern for most of the private equity practitioners polled in the latest unquote" Nordic Survey.

3i sells LNI stake for €36m

3i Group has sold its 5.7% stake in Lakeside Network Investments (LNI) to Teachers Insurance and Annuity Association of America for тЌ36m.