Nordics

PE-backed Touchpoint acquires Domino Workwear in Finland

Deal comes nearly two years after Finnish GP Taaleri Private Equity Funds acquired the company

Andreessen Horowitz leads €7.6m series-A for Mainframe Industries

Gaming startup has so far raised nearly тЌ10m from two funding rounds

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

CapMan to buy majority stake in Swedish firm PDS Vision

Deal will see minority shareholder Arctos Equity Partners exit the business

Secondaries: opportunistic buyers ready for fund stakes to hit market

With more sellers coming to market, prices are unlikely to stay at pre-Covid-19 heights, which could in turn encourage more opportunistic buyers

Promentum sells Danish AI business Grazper to Yokogawa

Danish venture capital firm exits the business after having invested in it in 2016

LP Profile: Kåpan Pensioner

Mikael Falck, head of alternatives, discusses the Swedish pension fund's appetite and exposure to the asset class

Gro acquires majority stake in Danish company Queue-It

Deal is Gro Capital's third investment from its GRO Fund II, a тЌ255m vehicle

Norgine acquires Azanta from European Equity Partners

Dutch pharmaceutical company Norgine had been a minority shareholder of the business since 2014

VC-backed Mercell acquires Aksess Innkjøp in Norway

Viking Venture acquired a minority stake in the business in 2018

Nordic buyout market has silver linings, despite low volume

Nordic region sees the lowest quarterly deal volume since Q4 2013, with just 17 buyouts in Q1 2020

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Coronavirus and private equity

All our latest coverage on the ongoing coronavirus crisis, and its impact on the European PE industry

Francisco Partners-backed EG acquires Holte

Deal comes nearly a year after Francisco Partners acquired a majority stake in EG from Axcel Management

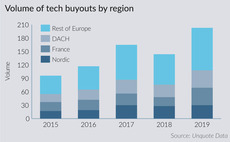

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

Secondaries buyers expect 30% volume drop over next two months - research

Five out of 37 buyers still appear opportunistic and expect activity to go up

New perspectives: How secondaries are reshaping PE's risk profile

With LPs increasingly hungry for PE, the boom of the secondaries market can shift perceptions around the risks associated with the asset class

Acuris coronavirus impact analysis

Assessing the early impact of coronavirus on capital markets and sectors

Innova to exit Polskie ePlatnosci in Nets sale

Innova Capital and other shareholders are to sell a total of 79.49%, and OPTeam is to sell 20.51% in PeP

Coronavirus: PE processes that could be affected

A round-up of ongoing and expected sale processes in sectors impacted by the coronavirus outbreak

Secondaries sea change: Backing your winners

What was once the preserve of the underperformer is now shifting towards the prized asset

Sparkmind holds first close for debut ed-tech fund

KRR III and Finnish Industry Investment back the fund as cornerstone investors