Nordics

EQT Ventures leads €4m round for gaming studio Reworks

Studio has launched its first game, Redecor, which targets home decor enthusiasts

Bokio raises €7.4m funding; acquires competitor Red Flag

Merged entity is reportedly valued at between SEK 500m-1bn.

Stirling Square acquires majority stake in Assistansbolaget

Deal is the Stirling Square's third investment from its тЌ950m fourth buyout fund

Unquote Private Equity Podcast: Fund financing in a fix

The Unquote team looks at how PE managers are turning to fund financing in a bid to shore up their portfolios

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Siili sells stake in Robocorp to existing PE backers

Siili exits the business after having invested in it during a pre-seed funding round

Marlin Equity-backed Puzzel acquires U-WFM

Deal allows Puzzel to speed up expansion into the UK market

KKR expects lower valuations for its portfolios due to Covid-19

GP forecasts that emergency restrictions will challenge its ability to market new funds and strategies

EC launches €300m platform Escalar

In its pilot phase, Escalar will provide up to тЌ300m, backed by the European Fund for Strategic Investments

Axcel holds first close for sixth flagship fund

GP's sixth fund has already raised 77% of the amount raised by its predecessor

Crescent European Specialty Lending Fund II closes on €1.6bn

CESL II invests in a diversified portfolio of private secured debt issued by European companies

Secondaries players hold fire despite copious dry powder

Market is likely to pause until Q2 2020 valuations are released, potentially leading to a flurry in Q4

Axcel acquires Norwegian company SuperOffice

Deal is the GP's first investment from Axcel VI, which was launched in December 2019

StepStone closes fourth secondaries fund on $2.1bn

SSOF IV's investment strategy focuses on the inefficient segments of the secondaries market

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

Insight Partners XI closes on $9.5bn

Fund deploys equity tickets in the $10-350m range in startups operating across the software industry

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Seed Capital leads €20m series-B for digital bank Lunar

Company also appoints former Monzo head of product to its board of directors

Welcome aboard: PE recruitment amid coronavirus

PE-focused recruiters and some GPs themselves are figuring out ways to progress recruitment processes, but challenges remain

Nordic Capital-backed Signicat acquires Connectis

Deal comes a year after Nordic Capital acquired Signicat from Viking Ventures

Main Capital buys majority stake in health software firm Alfa

Netherlands-based GP paid тЌ15-20m for its stake in the company

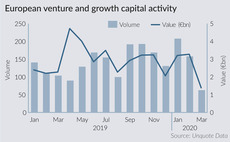

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services