Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Hutton Collins and LGV back Novus Leisure MBO

Hutton Collins and LGV Capital have backed the management buyout of bar and club operator Novus Leisure, which notably runs the Tiger Tiger brand.

N+1 makes 3.5x on ZIV sale

N+1 Private Equity has sold its 75% stake in Spanish digital equipment and services provider ZIV Aplicaciones y Tecnología to trade player Crompton Greaves for €150m.

Equistone sells Kermel to Qualium

Qualium Investissement has acquired a majority stake in French fibre manufacturer Kermel from Equistone Partners Europe, which is understood to have reaped a 2.2x money multiple on the sale.

Fondo Italiano provides capital to Hat Holding

Fondo Italiano di Investimento has committed capital to Italian investment company Hat Holding, allowing the firm to shift its focus from club deals to investments from a closed-end fund.

AXA PE acquires Fives from Charterhouse

AXA Private Equity has backed the management buyout of industrial engineering firm Fives Group in a deal that values the company at around €850m.

Finance Wales et al. complete Clinithink series-A

Finance Wales has taken part in the multi-million-dollar second tranche of a series-A funding round for UK-based healthcare software company Clinithink, alongside existing investors.

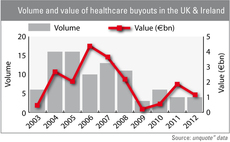

Are buyout firms well placed for healthcare reforms?

UK healthcare

Hony and GCS named preferred bidders for Dexia unit

Chinese private equity houses Hony Capital and GCS Capital have teamed up to buy the asset management arm of Dexia in a deal worth €500m, according to reports.

LDC takes Boomerang private

LDC has acquired AIM-listed media production company Boomerang in a take-private worth close to ТЃ8m.

Equita CoVest in €115m first close

Equita Management has held a €115m first close for its Equita CoVest fund.

North West Fund backs PlaceFirst

The North West Fund for Energy & Environmental, managed by CT Investment Partners, has acquired a minority stake in UK-based energy and regeneration business PlaceFirst.

Nordic Report 2012

Last yearтs closings of EQT VI (тЌ4.75bn) and HitecVision VI ($1.5bn) were not only the largest ever funds raised in their respective countries, but also signs of international interest in the region т both attracted significant global capital.

Slovakia looking to take over Penta-backed Dôvera

Slovakian prime minister Robert Fico is mulling a takeover of two private health insurance companies, in a move that could threaten Penta's investment in Dôvera.

Octopus appoints new investment director

Octopus Investments has appointed Shay Ramalingam as investment director in its specialist finance division.

€1.7bn bid for Rottapharm stalls

The bid launched by Clessidra Capital Partners and Avista Capital Partners for Italian drugmaker Rottapharm has ground to a halt due to share governance issues and fundraising difficulties.

Mid Europa backs Walmark

Mid Europa Partners has acquired a 50% stake in Czech dietary supplements manufacturer Walmark from the company's founders.

The State at play: Italian government jumpstarts flat market

The State at play

EIF commits €17m to Lithuanian SME funds

The European Investment Fund (EIF) has committed тЌ11m to the Practica Venture Capital Fund and тЌ6m to the Practica Seed Capital Fund.

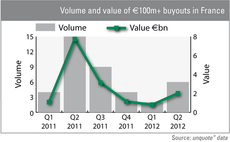

French mid-market on the mend

At long last, activity in the French €100m+ buyout market showed signs of improvement in the second quarter. The Alain Afflelou and St Hubert transactions certainly helped: the former was acquired by Lion Capital in an €800m SBO in May, while Montagu...

Cross acquires Micromacinazione

Swiss firm Cross Equity Partners has acquired a majority stake in Swiss micronisation technologies and services company Micromacinazione.

Siparex takes 25% stake in Vulcain

Siparex has acquired a minority stake in the owner buyout of French building fixtures manufacturer Vulcain.

MBO Partenaires buys 80% of LMB

MBO Partenaires has taken a majority stake in the management buyout of French aerospace parts supplier LMB.

RCapital Partners backs bChannel MBO

RCapital Partners has supported the MBO of UK sales channel management business bChannel.

IK buys Actic from FSN Capital

IK Investment Partners has acquired Swedish health and fitness business Actic from FSN Capital.