Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Blackstone France appoints chairman

Blackstone's special adviser Gerard Errera has been appointed as chairman of Blackstone France.

Equistone in talks for Explore Learning

Equistone Partners Europe is in exclusive talks to acquire Explore Learning, a UK-based firm offering maths and English tuition to 5-14-year-olds.

Rothschild closes first European secondaries fund on €259m

Rothschild has held a final close for its Five Arrows Secondary Opportunities III (FASO III) fund, exceeding its initial target of тЌ200m.

T-Venture backs DropGifts

T-Venture has backed Berlin-based social gifts start-up DropGifts with a seven-digit-euro investment.

Activa's Ergalis acquires three businesses

Ergalis, a build-up platform created by Activa Capital, has acquired French temporary employment agencies and recruitment services businesses Action Beauté Cosmétique Interim, Action Assistance and Talentpeople.

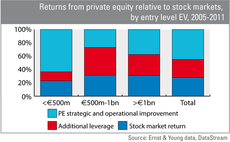

Mid-market leads value creation

Mid-market leads value creation

Perusa buys TLT Group

Perusa has wholy acquired German automotive logistics business Trans-Logo-Tech Group (TLT) via its €207m Perusa Partners Fund II.

Vertis backs Blomming

Italian investor Vertis has backed social network e-commerce site Blomming.

Moody's cuts German credit outlook

Moody's has indicated it may downgrade Germany's Aaa credit rating, which could make financing operations in Germany more difficult.

AIFMD having little impact on fund marketing

More than half of GPs say the Alternative Investment Fund Managers' Directive (AIFMD) has had little impact on their marketing activities with just a year to go until implementation, according to a survey by IMS Group.

Omnes Capital invests in Unafinance MBI

Omnes Capital (formerly Crédit Agricole Private Equity) has backed the management buy-in of French building security company Unafinance.

AXA PE buys Schustermann & Borenstein

AXA Private Equity has bought German fashion exporter Schustermann & Borenstein in an MBO that reportedly values the company at $370m.

Rutland appoints investment exec

Turnaround investor Rutland Partners has appointed Michael Reynolds as investment executive.

Mobeus in £18m Tessella MBO

Mobeus Equity Partners has pumped ТЃ18m into science-focused technology and consulting services provider Tessella, marking the GP's first buyout since its spinout from Matrix Group.

Imperial Innovations in £17m round for Cell Medica

Imperial Innovations Group has invested in a ТЃ17m funding round for its portfolio company Cell Medica.

Index et al. partially exit Funxional Therapeutics

Index Ventures, Novo A/S and Ventech have partially exited their investment in Funxional Therapeutics, following the companyтs sale of its rights to lead anti-inflammatory drug FX 125L to German pharmaceuticals company Boehringer Ingelheim.

August Equity's Enara makes string of acquisitions

August Equity's portfolio company Enara, a British care provider, has completed four add-on acquisitions as part of its buy-and-build strategy.

Italian and Russian banks to launch joint venture

Italian banking group Intesa Sanpaolo and Russian bank Gazprombank have signed an agreement to make private equity investments in medium-sized local companies.

Akina holds first close on €173.5m

Akina Partners has held a first close for its fifth fund-of-funds, Euro Choice V, on тЌ173.5m.

Espiga sells Invesa to Animedica

Espiga Capital Gestión has sold Industrial Veterinaria (Invesa), a Spanish pharmaceutical products manufacturer for the veterinary industry, to German firm Animedica Group.

Connection Capital appoints two

UK private client firm Connection Capital has appointed Robert Clarke as head of its investment committee and Julian Carr as investment director in the private equity team.

Doughty Hanson to reshuffle partnership structure

Doughty Hanson has announced a new GP structure, including limited liability partnerships, following the death of co-founder and majority shareholder Nigel Doughty in February this year.

Will Luxembourg lose prime spot as fund domicile?

Luxembourg losing out?

Mercapital makes €100m on Gasmedi sale

Mercapital has sold Spanish respiratory home therapies firm Gasmedi to French gas company Air Liquide for €330m.