Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

21 Centrale Partners creates outdoor accommodation group

21 Centrale Partners has created an outdoor accommodation group by merging its portfolio company Vacances Directes with newly acquired business Village Center.

Summit Partners raises $520m credit fund

Summit Partners has raised a $520m credit fund for middle-market companies, far surpassing its original $300m target.

Spain's CDTI to launch two venture vehicles

Spain’s Centre for the Development of Industrial Technology (CDTI) will soon launch two venture capital vehicles with capital commitments totalling €150m, according to reports in the Spanish press.

Capital Dynamics promotes five

Capital Dynamics has promoted five staff members to managing director since the start of 2012.

Maven backs four energy services companies

Maven Capital Partners has invested ТЃ5m of mezzanine funding in Scottish SMEs operating in the energy equipment and services sector.

AXA PE acquires frostkrone from Argantis

AXA Private Equity has acquired German frozen finger food producer frostkrone and its subsidiary Bornholter in an SBO from Argantis Private Equity.

LDC backs MBO of Dale Power Solutions

LDC has invested ТЃ10.5m to back the management buyout of power solutions provider Dale Power Solutions.

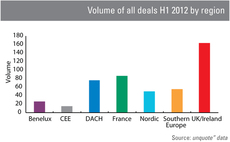

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

Inflexion closes £100m co-investment fund

Inflexion Private Equity has closed its 2012 Co-Investment Fund on its ТЃ100m hard cap, six weeks after sending out PPMs.

Foresight rocks out with £3.5m Blackstar investment

Foresight Group has injected ТЃ3.5m into UK-based guitar amplifiers manufacturer Blackstar.

Alvarez & Marsal hires managing director

Alvarez & Marsal has hired Rob Schuyt as managing director for its European restructuring business in Amsterdam.

LDC-backed Kirona buys Xmbrace

LDC portfolio company Kirona, which develops field force automation software, has acquired scheduling software developer Xmbrace.

HTGF et al in series-B for Customer Alliance

High-Tech Gründerfonds (HTGF), Mountain Super Angel, K5 Ventures and netSTART Venture have invested in a second round for Berlin-based software-as-a-service provider Customer Alliance.

Gimv acquires 25% stake in ARS T&TT

Gimv has invested growth capital in Dutch transportation services provider ARS T&TT in exchange for a 25% equity stake.

Equistone takes majority stake in Vivonio

Equistone Partners Europe has taken a 67% stake in German furniture maker Vivonio Furniture Group, a newco formed by combining Orlando Management-backed MAJA, Staud and SCIAE.

North West Fund backs Dot Medical

The North West Fund for Biomedical, managed by Spark Impact, has invested ТЃ550,000 in Dot Medical, which manufactures equipment to treat heart conditions.

Key Capital Partners backs £15m MBO of Nurse Plus

Key Capital Partners has backed the ТЃ15m MBO of UK-based healthcare staffing company Nurse Plus.

ISIS invests £5.2m in Pho

ISIS Equity Partners has committed to a ТЃ5.2m staged investment in independent UK-based Vietnamese street-food group Pho.

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner

Azulis and Galia inject €15m into Bio-Clinic

Azulis Capital and Galia Gestion have invested a joint €15m in French medical analysis laboratory Bio-Clinic.

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

Entrepreneurs favour banks over PE for funding

Less than a quarter of entrepreneurs expect to turn to venture capital and private equity firms for funding over the next 12 months, according to research by Investec.

Dunedin's CitySprint acquires Scarlet Couriers

UK-based distribution network CitySprint, backed by Dunedin Capital Partners, has acquired courier firm Scarlet Couriers.

Endless edges closer to Pizza Hut deal

Turnaround specialist Endless is in exclusive talks to acquire the UK business of Pizza Hut from parent company Yum! Brands, according to reports.