Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

EQT backs Sportradar

EQT has invested €44m in exchange for a minority stake in German sports data provider Sportradar.

Verdane Capital Advisors sells Prenax

Verdane Capital Advisors has sold Swedish subscription management company Prenax to French family office Arts et Biens.

Advent Life Sciences gets re-up for latest fund

Advent Life Sciences Fund I, a 2010 vintage venture vehicle managed by Advent Venture Partners, was reopened to accept a new commitment as well as increased investments from existing LPs.

Filas injects €1.2m into iLike.Tv

Italian regional investor Filas has injected €1.2m into online streaming and social media platform iLike.Tv.

Palero Capital acquires Tesa Bandfix

Luxembourg-based GP Palero Invest has acquired Switzerland-based Tesa Bandfix from its German parent Tesa SE in an all-equity transaction.

Litorina backs Gullbergs MBI

Litorina has acquired a majority stake in Swedish office supplies provider Gullbergs.

EdRIP et al. in CHF 25m GenKyoTex series-C extension

Edmond de Rothschild Investment Partners (EdRIP), Vesalius Biocapital Partners, Mitsubishi Pharma Corporate Venture and other investors have provided Swiss biopharma GenKyoTex with CHF 25m of early-stage funding.

Altor-backed Nimbus Boats goes under

Altor Equity Partners portfolio company Nimbus Boats has filed for bankruptcy.

VCs in £22m round for PsiOxus

Imperial Innovations and Invesco Perpetual have contributed ТЃ5.5m each to a ТЃ22m financing round in British biotech company PsiOxus Therapeutics.

Maven reaps 3.7x on Nessco exit

Maven Capital Partners has exited telecommunications provider Nessco Group in a ТЃ31m trade sale to US-based RigNet, generating a 3.7x money multiple on its original investment.

Buyers consider Permira-backed Valentino

A sovereign wealth fund is to make an offer for Italian fashion brand Valentino Fashion Group, owned by Permira.

BC Partners sells stake in Brenntag for €577.5m

BC Partners and co-investors have sold seven million shares in listed German chemicals company Brenntag, reducing their joint stake to 13.6%.

EQT raises €1bn for infrastructure fund

EQT has raised more than тЌ1bn for its second infrastructure fund, reports suggest.

Rabo Ventures and Value8 invest €4.5m in Ceradis

Rabo Ventures and Value8 have committed €4.5m to a new financing round for Ceradis, a Dutch producer of crop protection products.

Ventizz becomes Vorndran Mannheims Capital

German GP Ventizz has changed its name to Vorndran Mannheims Capital, reflecting its step towards a more buyout-oriented strategy.

BlackFin Capital Partners acquires MisterAssur

BlackFin Capital Partners has wholly acquired French insurance aggregator MisterAssur.

Hamilton Bradshaw backs Knights Solicitors

Commercial law firm Knights Solicitors has received a capital injection from Hamilton Bradshaw, the private equity firm owned by James Caan.

AXA PE nears €1bn Fives deal

Charterhouse is set to sell French engineering company Fives to AXA Private Equity and the company's management, according to reports.

Nova Capital Management exits Carbolite

Nova Capital Management has sold Carbolite Holdings to Dutch tech company Verder Group in a deal generating a gross equity return of 3.5x.

Apax, CVC, Carlyle and Trilantic bid for Euskaltel

Apax Partners, CVC Capital Partners, Carlyle and Trilantic are the final four bidders for 49% of Spanish telecommunications company Euskaltel, according to reports in the Spanish press.

Investcorp bids for 3i-backed Esmalglass

3i has received an offer of around €300m from Investcorp for Spanish ceramic enamel producer Grupo Esmalglass.

Have your say: where is the Italian market going?

unquote" is looking for your views on the Italian private equity market, ahead of our Italia Congress in November.

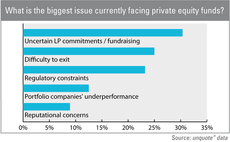

Fundraising a chief concern for Nordic PE professionals

While the AIFM Directive was on everybody's agenda last year, fundraising is the main concern for most of the private equity practitioners polled in the latest unquote" Nordic Survey.

3i sells LNI stake for €36m

3i Group has sold its 5.7% stake in Lakeside Network Investments (LNI) to Teachers Insurance and Annuity Association of America for тЌ36m.