Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

YFM backs Mynt Facilities with £650,000

YFM Equity Partners has injected ТЃ650,000 into Merseyside-based commercial cleaning business Mynt Facilities Services.

ISAI hires new deputy chief executive

French venture capital firm ISAI has appointed Pierre Martini as deputy chief executive.

Nordic unquote" June 2012

As previously reported last month, ratings agency Moodyтs has downgraded Swedish banks Nordea and Svenska Handelsbanken to Aa3, and Norwegian DNB Bank to A1 т all by one notch, with a stable outlook.

Northzone invests $3m in Soundrop

Northzone has invested $3m in Norwegian music discovery and sharing service Soundrop.

EQT picks up Vertu from Nokia

EQT Partners has acquired luxury phone business Vertu from Nokia.

Blackstone appoints senior adviser in Spain

Claudio Boada has joined Blackstone Group’s global private equity and real estate teams as a senior adviser.

LDC acquires Metronet from YFM

LDC has completed the management buyout of UK-based internet service provider Metronet from YFM Equity Partners and Acceleris.

Palatine adds two to advisory board

Palatine Private Equity has appointed Ian Darby and Michael Fort to its executive advisory board.

First close for ISAI's second FCPR fund

French venture capital firm ISAI has held a first close for its second FCPR vehicle, ISAI Expansion, on €30m.

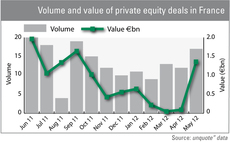

French activity: Out of the trough?

Shored up by an uptick in mid-market buyout activity, French dealflow has shown encouraging signs of recovery in May. But subdued activity in the first months of 2012 and a lack of visibility on macro-economic trends should take their toll on year-end...

Holtzbrinck Ventures and HTGF invest in Paul Secret

Holtzbrinck Ventures and High-Tech Gründerfonds (HTGF) have invested in Berlin-based start-up Paul Secret, a fashion adviser and retailer for men.

Turnarounds expect deal flood post-Olympics

The Diamond Jubilee and Olympics are detracting from private equity activity, though banks could at last be ready to sell their equity investments. Kimberly Romaine reports

Balderton dumps Sulake after documentary exposé

Balderton has dumped its stake in Finnish social networking company Sulake following a damning Channel 4 investigation into the firm.

Wellington Partners et al. invest in Readmill

Wellington Partners has joined previous investors Passion Capital and Index Ventures in a series-A funding round for German social reading platform Readmill.

Balderton Capital et al. in $16m round for Openet

Balderton Capital, Cross Atlantic and Kreos Capital have committed capital to a $16m series-D financing round for Irish management software provider Openet.

Endless appoints associate director

UK turnaround investor Endless has promoted Lucia Villamor to associate director.

Southern Europe unquote" June 2012

A recurrent refrain sung by the Italian private equity community and the name of a recent initiative that amplifies the chorus of voices calling for growth: Why Not Italy?, announced in May, unites top Italian private equity players in a bid to promote...

H2-backed Smartwares buys Hanesbrands Europe

Consumer essentials retailer Smartwares, a portfolio company of H2 Equity Partners, has wholly acquired Hanesbrands Europe as part of its buy-and-build strategy.

Apax leads $1bn Paradigm buyout

Apax Partners and JMI Equity have agreed to acquire oil & gas software vendor Paradigm from US investment group Fox Paine for around $1bn.

HTGF leads seed round for KeyRocket

High-Tech Gründerfonds (HTGF) has led a seed funding round for keyboard shortcut trainer KeyRocket, the launch product of start-up business Veodin Software.

CapMan Russia exits Tascom to trade player MTS

CapMan has exited Russian telecommunications firm Tascom to local trade player Mobile TeleSystems (MTS).

Next Wave acquires Molinare

Next Wave Partners has acquired UK post-production firm Molinare TV and Film Ltd.

Conor invests €1m in Omegawave

Conor Venture Partners has invested тЌ1m in Finnish sports training equipment provider Omegawave.

Market volatility threatens Evonik IPO

The RAG Foundation, which owns a majority stake in CVC-backed German chemicals maker Evonik, could cancel the company's IPO in light of the current market environment.