Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

OMERS PE acquires Lifeways from August Equity

The private equity branch of Canadian pension fund OMERS has acquired British healthcare services provider Lifeways from August Equity.

FSI Régions backs Solareo with €3m

FSI Régions has injected €3m into solar energy consultancy Solareo in exchange for a minority stake.

France unquote" June 2012

Sizeable French LBOs resembled the proverbial buses in May: you wait for one for an eternity, and then two appear at once.

VCs exit Esterel in €42m trade sale

CDC Innovation, Galileo Partners and Intel Capital have exited French software company Esterel in a €42m trade sale to US-based Ansys.

UK & Ireland unquote" June 2012

After several difficult years, Terra Firma may be turning its fortunes around and exorcising the ghost of EMI.

FIG launches VC fund for graduates

London-based venture capital firm Find Invest Grow (FIG) has launched its maiden vehicle, the FIG Concept Seed Fund.

VC-backed Meninvest raises €5.6m

Orkos Capital, 123Venture and Partech International have provided French e-commerce group Meninvest with a €5.6m funding round.

Sherpa acquires Dédalo division

Sherpa Capital has wholly acquired Dédalo Grupo Gráfico, the commercial printing division of Dédalo, from Spanish private equity house Ibersuizas and media conglomerate Grupo Prisa.

DN hits seventh exit in two years with Apsmart sale

DN Capital has exited UK mobile innovation company Apsmart in a trade sale to Thomson Reuters.

Seventure leads $4.7m series-C round in ProTip

Seventure and existing investors have injected $4.7m in French medical devices company ProTip.

CDC Entreprises et al. in €6.3m round for Link Care Services

CDC Entreprises, Siparex and iSource have provided French healthcare services provider Link Care Services (LCS) with a €6.3m funding round.

European Investment Fund appoints new chairman

The European Investment Fund (EIF) has appointed Dario Scannapieco as chairman of the board of directors.

Listed private equity recovery underway

Listed private equity

McDermott bolsters Paris team

Law firm McDermott Will & Emery has appointed three new partners and four new associates in its Paris office.

Sunstone Capital backs Adenium Biotech

Sunstone Capital has invested DKK 11m in Danish biotechnology company Adenium Biotech.

MML sells Industrial Acoustics to AEA

MML Capital Partners has sold noise control products manufacturer Industrial Acoustics to AEA Investors.

Polaris-backed STG acquires Dalaspår

Polaris Private Equity portfolio company Scandinavian Track Group (STG), a Swedish provider of railway construction and maintenance services, has acquired its competitor DalaspУЅr.

ICG backs Symington's in SBO

Intermediate Capital Group has invested in the secondary buyout of convenience food producer Symingtonтs from Bridgepoint Capital.

Inflexion acquires Marston Group from Gresham

Inflexion Private Equity has bought UK-based judicial services business Marston Group from Gresham Private Equity.

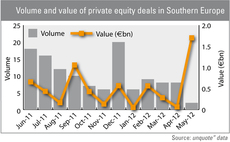

Southern Europe: Volume drops, value soars

Deal activity remained particularly subdued across Southern Europe in May, although the Rottapharm buyout in Italy sent overall value soaring.

DGPA backs L'Autre Chose

Italian private equity house DGPA has acquired a 55% stake in footwear brand L'Autre Chose for €8m, according to reports.

Polaris-backed Skånska Byggvaror acquires Grønt Fokus

Polaris Private Equity portfolio company SkУЅnska Byggvaror has acquired Norwegian furnishings business GrУИnt Fokus.

Foresight completes Aquasium partial exit

Foresight-backed technology company Aquasium has sold its electron beam subsidiary EBTEC to EDAC Technologies Corporation for approximately $11m.

Omnes et al. inject $4m into ividence

Omnes Capital and existing investor A Plus Finance have provided French email ad platform ividence with a $4m series-B round of funding.