Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Catapult invests in logistics company

Catapult Venture Managers has contributed ТЃ1.3m to a management buyout of specialist technology outsourcing and logistics company echo.

Entrepreneur Venture invests in Société Financière JF3H

Entrepreneur Venture has made a growth capital investment in Société Financière JF3H, the holding company of French coach travel operators Regnault Autocars and Nouvelle Aisne Tourisme.

Montagu strengthens French team

Montagu Private Equity has hired Antoine de Peguilhan as investment director and Adrien Sassi as analyst in its Paris office.

Darby appoints Podziewski head of Warsaw office

Darby Private Equity has appointed Arkadiusz (Arek) Podziewski principal and new head of its Warsaw office.

Terra Firma buys Garden Centre for £276m

Terra Firma Capital Partners has acquired British garden centre operator The Garden Centre Group from Lloyds for a total of ТЃ276m in equity and debt.

PE-backed MBI for ACB

Europe et Croissance and Arkéa Capital Investissement have backed the management buy-in of Belgian circuit boards manufacturer Advanced Circuit Boards (ACB).

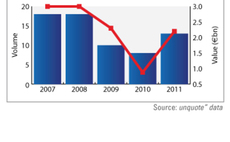

CEE's mid-market boom

CEE activity was subdued but with encouraging signs in 2011. Q1 saw just €1.7bn clocked up, but this was twice the sum of the whole of the previous year. Also, although activity in H2 was quiet, year-end figures nearly doubled to €2.6bn year-on-year....

Fresh €1.5m round for Novapost

Existing investors including Alven Capital and Fa Dièse have contributed to a €1.5m funding round for French electronic HR solutions provider Novapost.

Panoramic Growth injects £1m in Dog Digital

Scottish venture capital firm, Panoramic Growth Equity, has invested ТЃ1m in digital communications agency Dog Digital Limited.

Imperial Innovations leads £3m funding round in Abingdon Health

Imperial Innovations Group has led a ТЃ3m funding round in Abingdon Health, a specialist medical diagnostics company, alongside other private investors.

CDC Entreprises et al. in €7m round for E-Blink

CDC Entreprises has joined existing shareholders 360 Capital Partners, Masseran Gestion, I-Source Gestion and Alven Capital Partners in a €7m round for French telecoms company E-Blink.

HIG Europe acquires Brand Addition

HIG Europe Capital Partners has acquired Brand Addition and its subsidiary, Kreyer Promotion Service, from 4imprint in a ТЃ24m deal.

LDC backs Airline Services MBO

LDC has backed the MBO of aircraft maintenance company Airline Services.

De Pardieu Brocas Maffei appoints new counsel

French law firm De Pardieu Brocas Maffei has hired Maxime Dequesnes as counsel in its private equity practice.

HTGF invests in MediaMetrics

High-Tech Gründerfonds has invested €500,000 in Berlin-based solution software provider MediaMetrics.

Seventure and Lundbeckfond inject €5m in Enterome

Seventure Partners and Lundbeckfond Ventures have provided French biotech company Enterome with a €5m series-A round of funding.

Wellington invests in BonusBox

Wellington Partners has invested in German social commerce provider BonusBox.

Percipient generates 18x on Milmega exit

Percipient Capital has exited EMC testing and RF microwave specialist Milmega Limited making 18x its original investment and a 50% IRR.

Baird looking to raise £250m

UK-based mid-cap investor Baird Capital Partners Europe is currently raising a ТЃ250m fund, according to a source close to the situation. The firm's previous vehicle closed on тЌ204m in 2005.

CEE: Gearing up for a busier 2012

Successes persevere in Central and Eastern Europe, despite subdued deal activity, and concerns over currency volatility and financing. Greg Gille reports

Chancellor reneges on VCT investment cap

As part of yesterdayтs Budget, the government has confirmed that previously announced changes to the Enterprise Investment Scheme and VCTs will go ahead. But a retrospective change to the annual investment limit spells trouble for the VCT community and...

HTGF invests in hepatitis drug project

High-Tech Gründerfonds and Russian Government-backed Maxwell Biotech Venture Fund have invested in a joint project to develop a drug aimed at the treatment of chronic hepatitis B and D.

Altor exits SPT Group at 4-5x multiple

Altor Equity Partners has exited Scandpower Petroleum Technology (SPT) Group to NYSE-listed trade player Schlumberger.

YFM and MMC inject £1.5m into KnowledgeMill

YFM Equity Partners and MMC Ventures have co-invested ТЃ1.5m in London-based email management platform KnowledgeMill.