Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Bolster Investments buys minority stake in Infoplaza

Weather data provider uses the proceeds to fund the acquisition of market peer Weeronline

Aquiline-backed ClearCourse buys Practice Point

Practice Point's management team will stay on with the business, which will continue to operate independently

DIF Capital invests €82m in Touax Rail

GP is currently investing from its 2019-vintage DIF Core Infrastructure Fund II

Kester Capital closes second fund on £90m

GP also announced the refinancing of online gardening retailer YouGardem, scoring a 60% cost return

P101 in €6.4m round for WeSchool

CDP Venture and Tim Ventures take part in the round, alongside Club Digital and Club Italia Investimenti 2

Bid Equity buys majority stake in Infopark

Deal is the second from Bid Equity II, which held a close in November 2019 and targets B2B software

Nuo Capital, Olma in €4.5m round for Artemest

Early-stage investor Italian Angels for Growth and Swiss holding company Brahma also take part in the round

Priveq acquires majority stake in Trendhim

Company in 2019 generated revenues of DKK 115m, the equivalent of тЌ15.4m

Panakes et al. in €20m series-B for InnovHeart

Indaco Venture and CDP Venture Capital also take part in the round, alongside previous backer Genextra

PE-backed Nylacast acquires Supergrip

Deal is Nylacast's second add-on transaction since the GP acquired it in 2018

Jet Investment plans Jet 3 launch for late 2021

New vehicle's target is almost double the €153m that Jet raised for its second fund

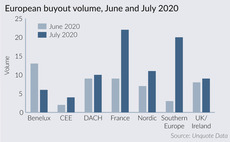

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

DvH Ventures launches Digital Health Fund

Dieter von Holtzbrinck Ventures (DvH Ventures) has announced the launch of its first Digital Health fund, which has held a first close on €60m.

Astorg sells Surfaces Group to TA Associates

Sale ends a three-year holding period for Astorg, which acquired a 75% stake in the company from Xenon PE

Rigeto Unternehmerkapital acquires Oehm & Rehbein

Acquisition of Germany-based x-ray equipment and software was backed by senior debt from ApoBank

Marlin invests in Pentalog

Marlin is currently investing from its Marlin Equity V vehicle, which closed on €2.5bn in March 2017

Triton's All4Labels buys GPS Label, Rotomet

Following the acquisition, GPS-Rotomet will operate under All4Labels, which Triton acquired in 2019

EMZ Partners invests in Ankerkraut

Founding Lemcke family will retain a majority stake in the Germany-based spice retailer

White Park, Navigator Capital carve out Gateway from Gunnebo

Subsidiary has since 2019 generated a loss for Gunnebo

Partners Group-backed Civica acquires InfoFlex

Omers Private Equity sold Civica to Partners Group for an enterprise value of ТЃ1.055bn in 2017

Synova-backed Fairstone acquires Chiltern House

Synova committed ТЃ25m to the development of Fairstone in 2016, drawing equity from Synova III

Vitruvian Partners sells Unifaun to Marlin Equity Partners

GP exits the business four years after acquiring a majority stake in it alongside the management

Genesis buys majority stake in R2B2

Deal is the first from the GP's Genesis Growth Equity Fund I, which is targeting €40m