Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Active Capital buys Delta Coastal Services

GP deploys capital from Active Capital Company Fund IV, which closed on €85m in September 2019

Italy embarks on the "deep tech" revolution

"Deep tech" startups specialise in transformative technologies, such as nanotechnology, industrial biotech, and advanced materials

Coronavirus and private equity

All our latest coverage on the ongoing coronavirus crisis, and its impact on the European PE industry

Viridor/KKR shows sponsor route to waste opportunities in Covid-19 market

Waste management, and particularly energy-from-waste, is fast becoming an area of heated dealflow

Francisco Partners-backed EG acquires Holte

Deal comes nearly a year after Francisco Partners acquired a majority stake in EG from Axcel Management

HBL acquires ZWT Wasser- und Abwassertechnik

GP will seek add-ons in Germany and elsewhere in Europe, as well as promoting organic growth

BayBG backs round for EverReal

Seed round extension follows the first round in November 2019, backed by HTGF and Seed X

UK industry welcomes rescue package, but concerns remain

Package includes ТЃ330bn in loans, ТЃ20bn in other aid and a postponement of business rates

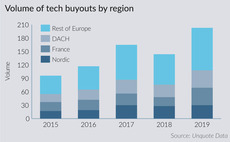

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached

Secondaries buyers expect 30% volume drop over next two months - research

Five out of 37 buyers still appear opportunistic and expect activity to go up

Omers-backed ERM acquires MJ Bradley & Associates

GP in 2015 paid an enterprise value of $1.7bn to acquire ERM from Charterhouse Capital Partners

Capricorn Partners, Novax back Prolupin

Existing investors Munich Venture Partners and eCapital Entrepreneurial Partners also participate

Baird Capital backs Aura Futures

Baird is currently investing from its maiden globally focused private equity fund, which closed on $310m

BGF leads £9m investment in Localised Group, Retail Services

As part of the deal, John Davison joins both companies as non-executive director

Axia buys insurance business Direct Gap

Gordons provides legal advice and Naylor Wintersgill provides financial due diligence services

Immatics acquired by sponsor-backed Arya

Immatics will receive proceeds of approximately $252m upon closing of the deal

RTP Global et al. back €18.5m round for Penta

Existing investor HV Holtzbrinck co-led the round for the Germany-based banking platform

Triton-backed Unica acquires PCT Koudetechniek

Deal is Unica's sixth acquisition under the ownership of Triton

CBPE sells SpaMedica to Nordic Capital-backed Ober Scharrer

Nordic Capital is currently investing from its ninth fund, Nordic Capital IX, which closed on тЌ4.3bn

Mediterra exits Mobiliz to GPS Bulgaria

Mediterra acquired Mobiliz for a total consideration of €5.05m in November 2012

ECI-backed IT Lab acquires Sol-Tec

Unquote understands ECI Partners provided no fresh equity for the acquisition of Sol-Tec

UK sees advisory boom amid PE market maturation

UK & Ireland sees an increase in the number of corporate finance firms participating in PE deals to more than 160

Inverleith-backed Planet Organic buys As Nature Intended

Deal reportedly makes Planet Organic the UK's largest organic grocery chain

Integral holds first close for debut fund

LP base currently includes institutional investors, as well as regional and international entrepreneurs