Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Tilia Impact on the market for EUR 32m early-stage fund

Czech VC eyes institutionals and HNWIs for impact-driven vehicle; first close expected by March

Vitruvian reignites exit plans for aviation data firm OAG

Sponsor expected to hire advisors in the next months for sale of asset held since 2017

Oakley Capital to partially exit Wishcard to IK, EMZ

Sale of German gift cards group sees founding management regaining majority position

Unigrains launches Italian unit with EUR 80m-100m investment plan

Milan-based operation will target agri-food businesses as sister fund FAI nears conclusion

Siparex exits Le Temps des Cerises in management-backed SBO

Trocadero Capital, Turenne and Smalt Capital join apparel brand as minority investors

Fasanara targets USD 110m first close for new fund by year-end

UK-based investor in talks with institutional investors to close USD 350m VC vehicle in H1 2023

ICG Enterprise Trust calls 60% shares-NAV discount 'anomalous'

Difference between value of portfolio and stock price тway too largeт, head of PE says

Aurelius exits Briar Chemicals to trade for EUR 83m

Fine chemicals group to become part of Safex Chemicals India's European business

Andera Life Sciences closes sixth fund above target on EUR 456m

Fundraising comes as LPs look for more diversification; VC fund will deploy EUR 5m-15m tickets in therapeutics, medtech

DEPO Ventures on the market for EUR 20m startup fund

Czech sponsor targets institutional investors, family offices and angel investors from CEE

Inflexion hires talent director from British International Investment

Freddy West will work with portfolio companies to accelerate businesses via human capital strategies

Graphite weighs Compass Fostering exit advised by Harris Williams

Sale unlikely to launch soon given downturn in children fostering services space

Financière Arbevel gears up for new life sciences fund first close

With EUR 100m target second vehicle seeks to attract regional entities of French banks

Eurazeo expects longer fundraising for flagship Fund V

EUR 3bn target to be partly funded by balance sheet; selective, resilient investments to attract LP's interest

Agilitas bolsters team with two new hires in London

Philip Krinks, Arnaud Moreels join pan-European sponsorтs ESG and investment teams

500 Emerging Europe set for EUR 70m fund close by year-end

Turkish VC’s second early-stage vehicle has so far received more than EUR 50m in commitments

Graphite Capital buys Digital Space from Horizon Capital

IT services business sold to UK-based mid-market sponsor in an SBO

Nordic Capital nears EUR 9bn final close for Fund XI

Expected to be 50% larger than its predecessor, new vehicle took six months to raise

BVCA Summit: "smart and ethical decisions" needed from PE, minister says

Economic Secretary Richard Fuller spoke about the industryтs role in the governmentтs growth plan

Clearwater Multiples Heatmap: PE deals at record value in Q2 as macro pressure mounts

Sponsor transactions in Europe surged to an all-time high with TMT and the UK leading the way

YFM reaps 4x-plus return in Springboard sale to US trade

Acquisition of footfall data analytics group will expand MRI Softwareтs retail solutions offering

Palatine exits Acora at 3x-plus money in sale to LDC

GP sells minority stake after less than three years invested in the IT managed services provider

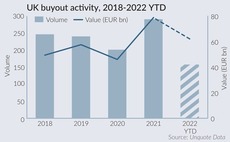

Down but not out: UK PE market confident in spite of sterling, macro concerns

Sponsors prepare to weather the storm and seize opportunities emerging from the crisis

Cathay reinforces PE team with a 14th partner for Paris office

French investment firm with USD 5bn AUM has appointed former Somfy VP Jean-Marc Prunet as partner