Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Summa co-invests in Castik-backed TBAuctions

Summa joins as shareholder after financing three Nordics-based bolt-ons for the online auctions platform

EMK Capital gears up for third fund

European mid-market investor held a final close for its predecessor fund in 2020 on EUR 1.5bn

Exponent sells Enra to Elliot Advisors

Exit reportedly values the UK-based specialist mortgage finance provider at more than GBP 350m

Limerston Capital buys Largo Leisure in first Fund II deal

Deal also marks the new fundтs first closing; GP to seek bolt-ons for the Scotland-based holiday park operator

Aztec Group appoints new chair to board

Kathryn Purves to succeed Patrick Gale as new board chair from 1 April

Innova exits Trimo for 4.5x money

Deal values the Slovenian buildings supplier at 9.5x 2021 EBITDA; GP's 2020 exit attempt collapsed after lengthy competition process

GP Profile: 17Capital eyes buoyant NAV financing market

Unquote speaks to managing partner Pierre-Antoine de Selancy about the GP's strategy and market view

Adams Street appoints BlackRock's Mioch as Benelux head

Joost Mioch will aim to build the GP's Benelux institutional client and consultant relationships

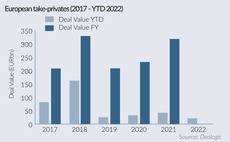

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

Palatine buys significant minority stake in Cura Terrae

GP becomes the single largest shareholder in the newly created UK-based environmental services group

DBAG acquires Akquinet

Listed German GP said in a statement that it has now invested in five IT service businesses to date

Apax leads GBP 175m round for ClearBank

Clearing and embedded banking platform is the first deal from the GPтs USD 1.75bn Apax Digital II

Clearlake, Motive to acquire BETA+ from LSEG for USD 1.1bn

GPs will use wealth management processing solutions provider as a buy-and-build platform and enter new high growth markets

GHO to explore Sterling Pharma exit this year

UK pharma manufacturing services asset could be marketed off GBP 50m EBITDA in a sale process in H2 2022

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

Bowmark explores Lawyers On Demand exit

GP appointed Rothschild to advise on the sale process, which is still in its early stages

The Bolt-ons Digest – 18 March 2022

KKRтS Biosynth Carbosynth, Agilitasт Cibicom, Apaxтs Graitec, Cairngorm's Verso, Altor's Trioworld, and more

DiliTrust backed by Eurazeo, Cathay, Sagard Newgen in EUR 130m deal

Transaction will see Calcium Capital exit the French corporate governance services provider; Eurozeo to contribute with EUR 52m

GRO Capital holds EUR 600m final close for Fund III

B2B software-focused fund is more than twice the size of its EUR 255m, 2018-vintage predecessor

Nordic M&A to withstand mounting macro and geopolitical pressures - panel

Restructurings, take-privates and US interest on the rise, while Q1 2022 buyouts are likely to drag behind

Advent acquires minority stake in Medius

Marlin Equity is reinvesting with a majority stake in the Swedish spend management software company

Hg gears up for MEDIFOX DAN exit

Houlihan Lokey will advise on the sale of the healthcare software group, which has already seen interest from large sponsors

WestBridge acquires Smart Capital Technology in MBO

GP invests GBP 17m following competitive auctions for IT services organisation company

Boots sale stumbles against limited financing availability

Asda and sponsors Apollo and Sycamore are said to be circling the auction of the Walgreens Boots Alliance-owned business