Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Access Capital awarded private equity mandate by ERAFP

Mandate will target mid-sized EU-based companies

Invitalia leads €700,000 round for Remoria VR

Backers include Italian venture capital house LVentures Group and several business angels

Altitude appoints Syvret as partner ahead of fund launch

New recruit joins from Santander and will oversee the raising of the GP's ТЃ20m second fund

Advent, Bain buy German payment service Concardis

GPs have acquired the business to lead a market segment consolidation across the DACH region

Palamon in SEK 765m SBO of Happy Socks

Transaction includes a growth capital component of SEK 40m

Sagard's third fund reaches €800m

Fund had been re-opened for subscriptions last year, after a first close on €500m in 2013

Mid Europa in €202m sale of Hungary-based Invitel to China-CEE Fund

Exit values the telecommunications business at 4.5x its 2015 EBITDA

Connection invests £5.4m in Clamason MBO

Precision metal pressing company will look to capitalise on its Slovakian manufacturing facility post-Brexit

Alpina backs German software developer Gefasoft

GP acquires an undisclosed stake in the business from its 2013-vintage Alpina Partners Fund vehicle

Chequers Capital exits Provalliance

Chequers exits the Paris-based hair salon operator after a four-and-a-half year holding period

BGF invests in Ultra Finishing

Deal marks the GP's second investment in north-of-England-based bathroom suppliers in six months

IK sells dental group Colosseum Smile to Jacobs Holding

GP exits Norway-headquartered dental group after a six-year holding

HenQ leads €5m series-A round for Housing Anywhere

New funding round brings the total amount raised by the Dutch startup to $6.27m

Wise's Biolchim purchases 70% stake in Matécsa

Deal marks the third bolt-on acquisition during Wise's ownership

Cinven promotes three to partner

Promotions of Europe-based team members come six months after the GP closed its sixth fund

Goodwin Procter appoints two partners to Paris office

Hires announced alongside firm's appointment of 26 London-based KWM lawyers

EMBL, Life Sciences Partners lead €8m series-A for Luxendo

GPs completed the funding round launched in 2015 with an additional €2m injection

Omnes holds final close for Omnes Croissance 4 on €210m

GP's fourth mid-cap fund had already hit its €180m target in July last year

TA Associates buys Think Project

GP acquired an undisclosed stake from former investor Walter Beteiligungen und Immobilien

Exponent sells Immediate Media to Hubert Burda in £270m deal

Sale of the UK media company values the business at around 7.3x its 2015 EBITDA

AFIC reinforces team with three promotions

Paul Perpère, France Vassaux and Antoinette Darpy will help promote France's private equity market

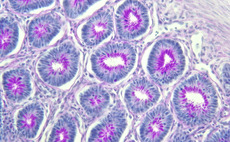

Boehringer Ingelheim leads €9m series-A for Heparegenix

Backers to the funding round include Novo Seeds and High-Tech Gründerfonds

Caixa, Kereon lead €2.5m round for Transplant Biomedicals

Deal marks the second round led by the two investors for the Spanish business

Indinvest leads $9.4m series-B for Ngdata

Deal marks the second tranche of the $20m series-B round for the business