Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Rutland buys Pizza Hut

Rutland Partners has acquired the UK restaurants business of Pizza Hut UK Ltd from parent company Yum! Brands, making a ТЃ20m equity injection into the firm.

Will VCs stand out from the crowd?

Crowd funding

Partners Group completes secondary share offering

Partners Group has successfully sold an additional 3,350,001 shares at CHF 183 per share on the SIX Swiss Exchange.

GA-Axel Springer joint venture acquires Immoweb.be

General Atlantic and Axel Springer's joint project Axel Springer Digital Classifieds has acquired Belgian property portal Immoweb.be for €127.5m.

Eurazeo and IDI post positive figures for Q3

French listed PE players Eurazeo and IDI have seen an uptick in their NAV per share in the three months between June and September.

Southern Europe unquote" November 2012

After a bleary-eyed summer, Southern European deal activity awoke in October with a notable increase in both volume and value.

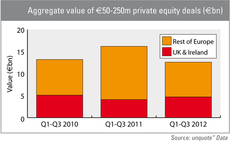

UK lower mid-market resilient in 2012

While activity in the тЌ50-250m segment has failed to improve on 2011 figures on a pan-European level, the UK is proving to be fertile ground for deal-making in an otherwise troubled macroeconomic environment.

Nordic unquote" November 2012

In the quest for high-quality deals that are convincing enough for banks to back and make investors excited about the coming fundraising round, Nordic players have looked towards infrastructure.

France unquote" November 2012

Saying that French private equity players have had a rough year so far in 2012 would be quite the understatement.

EdRIP to make 10x on Vessix sale

Edmond de Rothschild Investment Partners (EdRIP) stands to reap a sizeable 10x return on its original investment in US-based Vessix Vascular, following the $425m sale of the business to trade player Boston Scientific Corp.

DACH unquote" November 2012

Last month Germany’s former finance minister Peer Steinbrueck advocated a tough stance on private equity, saying banks should be banned from lending to private equity funds.

NBGI Ventures sells TPV to Bausch + Lomb

NBGI Ventures has sold its portfolio company Technolas Perfect Vision (TPV) to Bausch + Lomb, which has exercised an option acquired in 2011.

Waterland backs creation of Fleetpro

Waterland Private Equity has backed the merger of River Advice and International Shipping Partners by taking a majority stake in newco Fleetpro, a ship management company headquartered in Switzerland.

HTGF et al. back Cysal

High-Tech Gründerfonds (HTGF) and eCapital entrepreneurial Partners AG's vehicle Gründerfonds Münsterland have invested in German biotech business Cysal.

CEE unquote" November 2012

It’s no secret that fundraising is top of GPs’ worry list. Save for top-decile funds, GPs will find the trail ahead rockier, thornier, and quite possibly much longer than last time they ventured out.

Carlyle gives up on Chemring

Carlyle has decided against bidding for British listed military supplier Chemring, following two deadline extensions.

Southern Italian VCs shaping the industry's future

Southern Italy

Alcuin buys TileCo Group from Graphite

Alcuin Capital Partners has backed the management buyout of TileCo Group, a UK-based supplier of tile, mosaic and stone products, from Graphite Capital.

Swedish authorities continue to press for tax change

Sweden's tax authorities are vehemently pushing for a change in the taxation of proceeds for private equity fund managers.

Almi Invest et al. back PromoBucket spin-off

Almi Invest and 1:a VУЄstmanlandsfonden have backed the spin-off of Swedish software-as-a-service (SaaS) provider PromoBucket from advertising agency Navii.

Permira and SVG cash in on Galaxy Entertainment

Permira has sold its remaining stake in Hong Kong listed casino and hotel operator Galaxy Entertainment Group.

Benelux unquote" November 2012

To date, 2012 has not been a particularly impressive year in the Benelux region activity-wise.

UK & Ireland unquote" November 2012

The latest results from unquoteт data suggest the UK is on course to register similar levels of market activity in 2012 to that of 2011, despite a lacklustre September.

NVM finances CGI International bolt-on

CGI International, a manufacturer of fire resistant glazing backed by NVM Private Equity, has acquired France-based Interver.