Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

PE-backed Cortefiel refinances €1.3bn debt

Spanish clothing retailer Cortefiel, backed by CVC, Permira and PAI partners, has refinanced €1.3bn worth of debt, according to reports in the Spanish press.

Hamilton Bradshaw backs MBO of SF Group

Hamilton Bradshaw Private Equity has provided capital to support the management buyout of financial recruitment firm SF Group.

Innovacom leads €4.2m round for Olea Medical

Innovacom and existing investor EMAL have committed €4.2m to French medical software company Olea Medical.

Listed PE yields results

The investment landscape is rapidly transforming, reshaping itself almost beyond recognition as past follies take their toll on institutional investment powerhouses and new investors arise to take their roles in this new world. But will the much maligned...

Kennet leads $15m series-B round for Trademob

Kennet Partners, High-Tech Gründerfonds (HTGF) and Tengelmann Ventures have invested $15m in German mobile applications platform Trademob, according to reports.

Equistone buys Sunrise Medical Mobility from Vestar

Equistone Partners Europe has agreed to buy Sunrise Medical Mobility from Vestar Capital Partners.

Pangea Investors appoints new affiliate partner

Pangea Investors has hired Paul Bijleveld as an affiliate partner in the firm's London office.

The irrelevance of fees

Fees: irrelevant?

FSI Régions et al. back Groupe SAF

FSI Régions, CDC Entreprises, BNP Paribas Développement, Amundi Private Equity, Crédit Agricole des Savoie Capital and Portuguese trade player United Helicopter Service (UHS) have invested in French helicopter rescue business Groupe SAF.

August Equity's SecureData acquires Quadrant

August Equity portfolio company SecureData has completed the bolt-on acquisition of UK online security company Quadrant Networks Ltd.

Police investigate 2007 sale of Valentino to Permira

Italian police have seized assets worth €65m from the Marzotto family and its business associates under suspicion of tax evasion connected to the 2007 sale of Valentino to Permira, according to reports.

AXA PE opens Beijing office

AXA Private Equity has opened an office in Beijing, its first in China.

Supremum leads €2m financing round in Atosho

Supremum Capital has joined existing investors in a тЌ2m financing round for Danish e-commerce business Atosho.

Turkey rises to the challenge

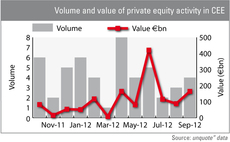

Turkey is slowly but surely establishing itself as a prominent market for private equity in Central and Eastern Europe along with Russia and Poland.

HTGF et al. invest in Synapticon

High-Tech Gründerfonds (HTGF), Seedfonds Baden-Wuerttemberg (SFBW) and private investor Günter Lang have invested €1m in German robotics company Synapticon.

Special Report: Italy

Special Report: Italy

Avedon Capital Partners backs Seebach MBO

Avedon Capital Partners has acquired German filtration specialist Seebach together with the company's management.

Piper names two brand experts to team

UK consumer brand specialist Piper Private Equity has appointed two associate partners.

Caixa Capital Risc backs Xtraice with €800,000

Caixa Capital Risc has injected €800,000 into Xtraice, a manufacturer and distributor of ecological synthetic ice.

Partners Group to increase direct investments

Partners Group plans to generate CHF 300m for direct investment through listing privately held shares in a bid to meet clients' interests.

Caledonia hires associate director for unquoted division

Caledonia Investments has hired Sally Flanagan as associate director of its private equity and venture capital pool.

DFJ Esprit exits Redkite

VC firm DFJ Esprit has exited its minority holding in UK-based financial markets surveillance specialist Redkite Financial Markets.

Incitia sell T-VIPS stake in merger with Nevion

Incitia Ventures has sold its 26% share of Norwegian video transport company T-VIPS through merging the business with Herkules Capital portfolio company Nevion.

Investindustrial in €439m PortAventura deal

Investindustrial has acquired the remaining 50% stake of its existing portfolio company PortAventura, a destination resort in Spain.