Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Spark backs Compliance Control with £110,000

Spark Impact has injected ТЃ110,000 into Compliance Control, a software company targeting the biomedical industry.

N+1 buys majority stake in Secuoya

Spanish GP N+1 has acquired a 55% stake in audio-visual services and television content provider Grupo Secuoya.

YFM in £3m round for ImmunoBiology

YFM Equity Partners has contributed ТЃ900,000 as part of a ТЃ3m funding round for Cambridge-based biotech firm ImmunoBiology.

JC Flowers injects £65m into mortgage business Castle Trust

US private equity investor JC Flowers has committed ТЃ65m in equity to the launch of Castle Trust, a provider of retail mortgages.

French PE industry "could collapse", AFIC warns

French PE industry

BPE 3 holds first close at €55m

BPE's third fund, BPE 3, has held a first close on €55m.

KKR leads buyout of Acteon from First Reserve

KKR and White Deer Energy have acquired a 52% stake in British oil and gas exploration services provider Acteon Group from First Reserve Corporation.

Quilvest-backed Tortilla secures £2.25m refinancing

Tortilla, the Mexican fast food group backed by Quilvest, has secured ТЃ2.25m in new bank financing from Santander Corporate Banking.

BPE exits TSK to trade buyer

BPE has sold German electrical components quality controller TSK Beteiligungs GmbH and its operating company TSK Pruefsysteme to Swiss trade buyer Komax.

BGF backs Broadbandchoices.co.uk with £10m

The Business Growth Fund has injected ТЃ10m into home communications price comparison site Broadbandchoices.co.uk.

UK & Ireland unquote" September 2012

While Britain can boast it is home to some of Europeтs largest financial institutions, including banks and private equity funds, it is also now regrettably facing some of its biggest asset disposals.

France unquote" September 2012

AXA Private Equity (AXA PE) may have mainly attracted attention last year with the start of its spinoff from French insurer AXA, but the firm has made a point of letting its deal teams do the talking in 2012.

Teaching firms how to grow

Education is playing an increasingly pivotal role in a GP's strategy to drive the growth of its portfolio companies. Amy King investigates

GFH Capital acquires Leeds United

Dubai-based GFH Capital has acquired Leeds City Holdings, the parent company of Leeds United Football Club.

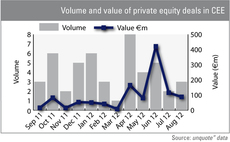

CEE picking up the pace

Dealflow in the CEE region picked up slightly in August, and the handful of deals closed so far in September hints at a busy Autumn ahead.

Benelux unquote" September 2012

At the end of 2011, key players in the Dutch and Belgian private equity markets had mixed views about the market and how it would develop in the eye of the eurozone crisis and looming regulatory constraints.

UK Green Investment Bank appoints ex-PE exec as CEO

State-backed Green Investment Bank has appointed Shaun Kingsbury, a former partner at private equity house Hudson Clean Energy Partners, as chief executive officer.

Gimv reshapes strategy to boost future growth

Belgian GP Gimv has announced an overhaul of its strategic orientation and management team, in order to strengthen its position in the industry.

CEE unquote" September 2012

August has seen at least two articles in the financial media slam the CEE region.

AXA PE buys 70% stake in Bruni Glass

AXA Private Equity has acquired a 70% stake in Italian glass containers producer Bruni Glass.

Aster Capital to reduce fund target

French corporate-backed venture capital firm Aster is said to be aiming for a €105m final close for its second fund, down from an initial €120m target.

SoftBank Capital leads €30m round for Criteo

SoftBank Capital has led a €30m series-D funding round for French display advertising firm Criteo.

Amundi takes 7.5% stake in French GP NextStage

French asset manager Amundi has bought a 7.5% stake in small-cap specialist NextStage from financial holding Artémis.