Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

MTI Ventures and Spark back BiOxyDyn with £1.2m

Medical imaging firm BiOxyDyn has secured capital commitments totalling ТЃ1.2m from Spark Impact and MTI Ventures.

Strong economy belies faltering buyout market in Germany

With debt scarcely available and cash-rich corporates looking to diversify through acquisitions, Germany’s buyout market has suffered a heavy blow these last few years - but it is still well-placed to take advantage of opportunities. John Bakie reports...

NBGI's Praticdose to merge with Cima

NBGI Private Equity has completed the bolt-on acquisition of French healthcare equipment provider Cima, which will be merged with Praticdose.

Just-Eat bolts on SinDelantal.com

Just-Eat, the online takeaway ordering service backed by an investor consortium, has acquired its Spanish equivalent SinDelantal.com.

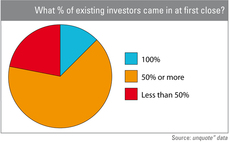

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

Blackstone and Anacap set up joint venture for financial assets

The Blackstone Group and Anacap Financial Partners have set up a joint venture to buy European financial assets.

Apax France buys Texa

Apax France has bought Texa, a French insurance services business, alongside the company's founder and management in a quaternary buyout from Pragma Capital.

Kernel Capital invests in IHG

Kernel Capital has led a тЌ400,000 financing round for Irish embedded audio player company In Hand Guides (IHG).

TLcom backs Beintoo with $2m

London-based VC TLcom Capital has injected $2m into Beintoo, an Italian provider of loyalty programmes for apps and websites.

Baring Vostok raises $1.5bn for fifth fundraising effort

Baring Vostok has held a final close for Baring Vostok Private Equity Fund V LP and Baring Vostok Fund V Supplemental Fund LP, raising a total amount of $1.5bn.

LDC's A-Gas buys US-based Coolgas

LDC-backed A-Gas International has bought Coolgas, a US-based refrigeration supplier and distributor.

Motion Equity Partners exits ixetic

Motion Equity Partners (formerly Cognetas) has agreed to sell German car parts manufacturer ixetic to Canadian automotive supplier Magna, a deal reportedly worth €308m.

Gilde Healthcare Partners et al. back Definiens

Gilde Healthcare Partners has led a €10m funding round for German image analysis company Definiens.

Activa's Primavista completes bolt-on

Primavista, a maternity and school photography company backed by Activa Capital, has bought Secret de Polichinelle, an internet company focusing on wedding and birth announcement services.

GE Capital appoints German head of leveraged finance

GE Capital has appointed Ralph Betz as head of its German leveraged finance team in Frankfurt.

Shareholders reject Trilantic's bid for Euskaltel

Shareholders in Basque telecommunications group Euskaltel have rejected Trilantic’s bid for the company due to disagreements over the company’s valuation, according to reports in the Spanish press.

NEO backs Miller Harris

NEO Capital has invested in British luxury fragrance brand Miller Harris to support its international expansion.

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

Seventure's Biophytis secures €2m B-round funding

Seventure Partners and CM-CIC Capital Privé have joined new investor Metabrain Research in a €2m series-B financing round for French pharmaceuticals company Biophytis.

Seventure's Biophytis secures €2m B-round funding

Seventure Partners and CM-CIC Capital Privé have joined new investor Metabrain Research in a €2m series-B financing round for French pharmaceuticals company Biophytis.

ECI backs rhubarb MBO

ECI Partners has backed the MBO of luxury catering brand rhubarb, investing ТЃ12m in exchange for a minority stake.

unquote" 60-second survey Q3 2012

Have your say

Gresham PE acquires Investis

Gresham Private Equity has acquired a majority stake in digital corporate communications company Investis in a ТЃ25m MBO.

Phil Frame joins NorthEdge

NorthEdge Capital has appointed Phil Frame as senior investment executive in its Manchester office.