Southern Europe

BC sells Pharmathen to Partners Group in EUR 1.6bn deal

BC Partners acquired the Greece-headquartered generic pharmaceuticals developer in 2015 for EUR 475m

GP Profile: FSI back on the hunt for deals

CEO Maurizio Tamagnini discusses FSI's approach to the post-pandemic market to identify new investments, and its plans for a second fund

Ermenegildo Zegna merges with Investindustrial-backed Spac

Merged entity will have an anticipated initial enterprise value of USD 3.2bn

EQT to collect non-binding offers for Adamo next week

Ardian is also among the suitors interested in submitting an NBO, one source says

H&F holds USD 24.4bn final close for 10th fund

Large-cap buyout specialist closed its predecessor fund in October 2018 on USD 16bn

One in four LPs willing to trade lower performance for better ESG - survey

ESG-focused LPs "motivated to divest positions in funds where they perceive ESG efforts to be lacking"

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

EQT sells Igenomix in €1.25bn trade sale

Igenomix had a €400m enterprise value at the time of EQT's initial investment in 2019

DN Capital holds final close for fifth fund on €300m

Vehicle surpassed its тЌ200m target and is тЌ100m larger than the firm's fourth fund

Stirling Square acquires Sustainable Agro Solutions

GP intends to support the Spain-based biostimulants producer with market consolidation

Aliante Partners secures preferred equity with Pomona

Deal includes a liquidity option for LPs and a second preferred equity line for add-on acquisitions

Fundraising Report 2021: mapping out the post-Covid landscape

Unquote analyses key trends and presents proprietary data on the European fundraising market

US, UK ranked as most attractive countries for PE investment – study

France makes it into the top 10 for the first time, while Spain also records strong gains

Apollo makes first deal from Impact strategy

Apollo will launch a take-private bid for the recycled cardboard producer on completion of the deal

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

Investindustrial exits Polynt-Reichhold in buy-back

Asset was expected to fetch around тЌ2.5bn, with Lone Star previously thought to be in exclusivity

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed

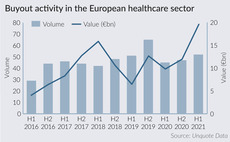

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Cinven buys Arcaplanet from Permira in €1bn-plus deal

Pet care retailer reportedly fetched more than €1bn

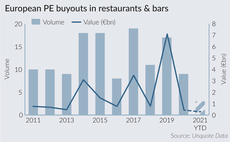

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Ares takes 33% stake in Atlético Madrid

Club shareholders unanimously agree to a €181m capital increase

Artá Capital becomes independent, eyes €400m for Fund III

Management team buys out Corporación Financiera Alba's stake in the Spanish GP

LBO France hires Ethica for Vetroelite exit

Auction for the Italian specialist containers manufacturer is expected to kick off in September