Southern Europe

Faber launches €30m second tech fund

Fund is dedicated to early-stage rounds, with a focus on data science, artificial intelligence and machine learning

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Speedinvest holds first close for Speedinvest x Fund 2

VC also announced the appointment of Tier Mobilty co-founder Julian Blessin as partner

Quadrivio acquires fashion brand GCDS

GP deploys capital from Made in Italy Fund, which targets companies across the fashion, design and food industries

Capvis buys Arag

GP invests in the company via Capvis Equity V, which held a final close on €1.2bn in September 2018

MCH sells Lenitudes, invests in Atrys

Sale ends a six-year holding period for MCH, which acquired a 66.5% stake in Lenitudes via its third fund

Portobello Capital raises €350m secondaries fund

Fund is dedicated to promoting the growth of Angulas Aguinaga and Industrias Alimentarias de Navarra

DeA Capital buys Gastronomica Roscio

This is the first deal inked by the GP via Taste of Italy 2, which recently held a final close on €330m

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

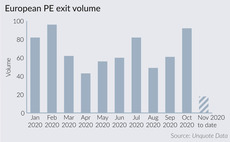

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

PAI acquires Angulas Aguinaga from Portobello

PAI invests in the company via its PAI Mid-Market Fund, which recently held a €500m first close

All Iron Ventures I closes on €66.5m

Fund invests in innovative B2C companies, primarily marketplaces, e-commerce specialists and SaaS startups

Taste of Italy 2 closes on €330m

Taste of Italy 2 will invest in companies specialised in the food and beverage sector, across its entire value chain

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

Archeide launches €50m VC fund

Fund will target Italian startups developing innovative products and applications

Clessidra buys Coefi from Archeide

Sale ends an eight-year holding period for Archeide, which has supported the growth and expansion of Coefi since 2012

Orienta backs engineering specialist LMA

With Orienta's support, the company plans to further boost its expansion, both organically and via new acquisitions

360 Capital to launch €50m Square II fund

360 Square II will deploy equity tickets of €500,000-3m, primarily across France and Italy

Preparing for the turnarounds wave

The much-anticipated wave of distressed opportunities has failed to materialise so far, but market participants are still readying for an uptick

Sherpa appoints Medina as operating partner

Medina joins Sherpa's portfolio management team, with the role of adding value to the firm's investee companies

Sponsor-lender relationship faces stiff Covid-19 test

GPs' relationships with their existing banks and debt funds will remain key to managing the ongoing consequences of the crisis

CDP, StarTip, Vertis in €5m round for Buzzoole

Company intends to use the fresh capital to develop its new tool Discovery and further boost its expansion

Secondaries update: Unigestion's David Swanson

Secondaries activity is recovering from the initial coronavirus-related shock, with good prospects for GP-led secondaries deals

MIP leads €5m round for Exoticca

This round is an extension to an €11m series-B investment raised by the company in July 2019