Southern Europe

IGI holds €100m first close for sixth fund

Fund was launched with a €150m target and is larger than its predecessor, IGI Investimenti Cinque

Green Arrow holds €136.2m final close for private debt fund

Fund inherited the portfolio of Quadrivio Private Debt after the GP was acquired by Green Arrow

MIP leads €5m round for Miscusi

Restaurant chain will scale up its team and further expand in northern Italy

Alchimia's uFirst buys LVenture-backed Qurami

LVenture will sell its stake in Qurami for both cash and a stake in the acquiring company

Ambienta buys AromataGroup

Current management team will continue to lead the firm and retain a minority holding

Italglobal Partners acquires Gimel

GP led a club of investors to acquire a 70% stake in the Italian children's clothing manufacturer

United Ventures' Moneyfarm buys Vaamo Finanz

Following the deal, Vaamo co-CEOs Thomas Bloch and Oliver Vins will join Moneyfarm's executive board

Red Capital launches €50m fund to back female-led startups

Newly founded VC firm will be EMEA's largest VC fund investing in female-led businesses

Riverside generates 4.3x on sale of Euromed

Riverside makes the divestment from its $340m buyout vehicle, Riverside Europe Fund V

Single-asset funds afford slow and steady pace

When a fund approaches the end of its lifespan, transferring the last remaining investment into a new vehicle is proving increasingly popular

Neuberger Berman, NB Aurora exit General Medical Merate

NB's stake was acquired by the Sordi family and Kangda Medical Equipment Group

Invitalia Ventures, Primomiglio lead €3m round for Brandon

Sella Ventures, Sinergenis, Ecilog and private investor Fabio Cannavale also take part in the round

C5 Capital leads $18m funding round for 4iQ

C5 Capital will take a seat on the company's board of directors following the deal

Goldman Sachs leads $28m round for Unicaf

Online higher education company will increase its number of scholarships to more than 100,000

Wise-backed Tatuus bolts on Breda Racing

GP plans to boost the two companies' internationalisation and achieve strong operational synergies

Oaktree exits Eolia Renovables

Sale ends a three-year holding period for Oaktree, which bought the company in a €1bn deal

One Equity-backed Lutech bolts on Tecla.it

Deal also includes the acquisition of two subsidiaries controlled by Tecla.it

F2i holds €3.6bn final close for third fund

Vehicle was launched with a €3.3bn target and held a €3.14bn first close in December 2017

Ambienta exits Aico

Sale ends an eight-year holding period for Ambienta, which bought the company via its first fund

Carlyle-backed Codorníu bolts on Gleva Cellars

Gleva Cellars CEO Ramón Raventós Basagoiti will be appointed CEO of the combined group

NB Renaissance Partners' Comelz bolts on Camoga

Following the acquisition, Comelz expects to reach EBITDA of €30m from revenues of €75m in 2018

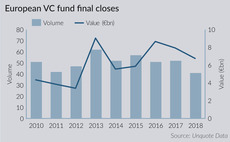

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

BC Partners' Cigierre bolts on Pony Zero

Company will use the fresh capital to expand its service offering and enlarge its customer base

Luxury fashion à la mode for private equity buyers

Sky-high valuation of Versace at тЌ1.83bn equates to 41x the company's 2017 EBITDA of тЌ44.6m