UK / Ireland

McWin closes EUR 500m restaurant fund backed by ADIA

Food specialist also set to start fundraising for EUR 250m food tech vehicle next month

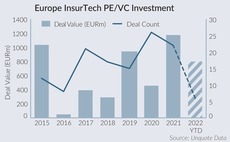

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

LDC reaps 4x returns in Aqualisa GBP 130m trade exit

US-headquartered Fortune Brands plans to accelerate growth of shower products manufacturer

Aurelius to buy Footasylum following antitrust ruling

Deal values high street sneaker retailer at EUR 45m as owner JD Sports forced to divest

Aliter Capital readies Ipsum for post-summer auction

DC Advisory to lead on sale of UK-based utilities and infrastructure services provider

CD&R to form facilities management group with two primary buyouts

Family-owned Atalian and OCS will merge to create platform with presence in Europe and Asia-Pacific

Deutsche Bank head of EMEA equity-linked departs

Xavier Lagache is no longer in the role after more than a decade; replacement not announced

Synova V holds first and final close on GBP 875m hard-cap

The fund has a GBP 250m pool earmarked for smaller deals and expects to make a handful of DACH and Nordics investments

StepStone Group gears up for next Tactical Growth Fund

Predecessor primary, secondaries and co-investment vehicle held a final close in 2021 on USD 690m

Unquote British Private Equity Awards 2022: final week to enter

Submissions for the 2022 Unquote British Private Equity Awards are open until 29 July at 5pm

Squire Patton Boggs poaches Gateley's head of corporate

Tom Durrant joins the US-headquartered law firm after 15 years at Gateley

CBPE in exclusivity to acquire Palatine-backed Veincentre

UK varicose vein treatment clinic was put up for sale in a Grant Thornton-led auction

FPE Capital bolsters investment team

Ben Cole promoted to investment director at the software and services growth investor

Pemberton strengthens team with four senior hires

Anders Svenningsen, Christoph Polomsky, James Taylor and Sally Tankard join the firmтs European offices

LDC mandates Houlihan Lokey for MSQ Partners exit

Formal auction for the UK-based marketing communications group has not yet been launched

ECI sells Bionic to Omers reaping 4.8x

Following the sale of the UK-based SME price comparison platform, ECI will reinvest via ECI 10

VC Profile: Vektor Partners backs tech mobility transformation with new fund

VCтs debut fund has a EUR 175m hard-cap and aims to back startups with initial tickets of EUR 3m-EUR 5m

Tenzing sells CitNOW to Livingbridge; reaps 9.6x return, 74% IRR

The vendor will continue to back the UK-based car dealership software group via other funds

Nest mandates HarbourVest for PE investing

Workplace pension scheme has made its second PE mandate following its partnership with Schroders

Cinven plays long game with financials fund in hunt for 3x returns

With a life of 15 years, the new vehicle has closed above target, with insurers making up about a quarter of its LP base

BGF announces changes in leadership

CIO Andy Gregory to head UK growth investor as Stephen Welton is made non-executive chair

Astorg, Epiris to split Euromoney in two in GBP 1.6bn agreed offer

The deal will see Astorg carve out the Fastmarkets commodity pricing brand, with the remaining business controlled by Epiris funds

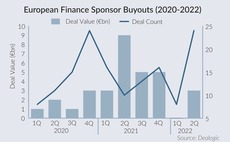

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Epiris buys Sepura in EUR 159m carve-out deal

UK-based manufacturer of digital walkie-talkies was divested by Chinaтs Hytera Communications