Healthcare

Tesi, Debiopharm lead €4.4m series-A for Kaiku Health

Finnish growth investor Prodeko Ventures participated in the round, alongside existing investors

Connection Capital backs HEL

Connection Capital invests ТЃ5.9m in the UK-based lab equipment manufacturer to boost growth

Main Capital-backed RVC buys Allgeier

Combined group will operate under the name RVC Medical IT and targets revenues of €10m for 2018

Apposite acquires OrthoD from The Riverside Company

Deal is the fifth investment for healthcare-focused GP Apposite's latest vehicle

Qiming in $12m series-A for LetsGetChecked

Healthcare self-testing company will invest in technology development and recruitment

Ampersand invests in MedPharm

UK-headquartered provider of drug-related products and devices will look to expand internationally

G Square backs Pharmacy2U

Following the investment, G Square will become Pharmacy2U's majority shareholder

Ardian sells Groupe Bio7 to trade

Buyer Cerba HealthCare is owned by Partners Group and Canadian pension fund PSP Investments

Sofinnova leads €6m series-A for SafeHeal

Fresh capital will be used to develop a clinical and regulatory market access programme for Colovac

Seventure holds first close on €24m

France-based animal nutrition specialist Adisseo is among Seventure's AVF fund investors

BGF divests Duncan & Todd as part of LDC-led SBO

Opticians group will pursue an acquisitive growth strategy under LDC's ownership

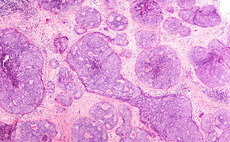

Principia leads €10m series-A for CheckMab

GP deploys capital from its healthcare-dedicated vehicle Principia III to finance the investment

GIC in £100m round for Oxford Nanopore

Deal gives the UK-based gene-sequencing devices company an equity valuation of ТЃ1.5bn

VC firms sell Prexton to Lundbeck for up to €905m

Vendors include Sunstone Capital, Ysios Capital Partners and Forbion Capital Partners

Palamon makes 3.6x on sale of Ober Scharrer to Nordic Capital

Sale is the 16th realisation from Palamon’s 2006-vintage fund, Palamon European Equity II

NCL Technology Ventures launches £50m fund

Fund will invest in high-growth SMEs, with a focus on medical technologies and therapeutics

Hg exits Frösunda after eight-year holding

Pan-European investor sells its majority stake in FrУЖsunda to holding company Brado

Cathay and OrbiMed divest Echosens to Astorg

Deal is the first exit for Cathay's 2014-vintage €500m Sino-European MidCap fund

Techwald's SPAC Life Care Capital to trade on AIM Italia

SPAC will invest in non-listed medium-sized Italian companies active in the healthcare sector

Horizons co-leads $15m funding round for Owlstone

Aviva Ventures co-led the round, which also saw investment from existing investors

Mid Europa buys MediGroup from Blue Sea Capital

Seller Blue Sea Capital, which established MediGroup in 2013, will retain a 45% stake

Abraaj suspends private equity funds as founder steps down

CEO and founder Arif Naqvi passed the fund management reins to two co-chief executives

Mezzanine Management backs Nettle with PLN 100m

Investment has been structured as a capital increase in the company and long-term mezzanine loan

Agic, Capvis, Gilde, Nordic Capital in final Amann Girrbach round

Nordic Capital is reportedly the front-runner in the sale of the Austrian dental prosthetics company